Why Getting Your Finances Together Sometimes Feels Like It's Making Things Worse

You finally did it. You gathered all your statements, logged into all your accounts, and looked at the full picture of your money situation.

And now you feel worse than you did before you started.

The debt looks bigger when it's all written down in one place. The gap between what you earn and what you spend feels impossible to close. That retirement account balance (or lack of one) is more depressing than you imagined. You thought getting clarity would make you feel better, but instead you're sitting there thinking, "How did I let it get this bad?"

If this is where you are right now, I need you to hear this: What you're feeling is not only normal—it's actually a sign that you're doing it right.

I know that sounds strange. How can feeling worse be a good thing? Let me explain.

If You Haven't Looked Yet, Read This First

Maybe you're not quite at the "I just looked at everything" stage yet. Maybe you picked up this article because you know something is off with your money, but you haven't actually looked at the full picture. You're still in the "I should really figure this out, but I'm scared to look" phase.

If that's you, I want you to know two things:

First: What I'm about to describe in this article—that feeling of things getting worse before they get better—is exactly what you'll experience when you do finally look. I'm not telling you this to scare you away. I'm telling you so you can be prepared and understand it's normal.

Second: The avoidance you're feeling right now? That's normal too. Every single person I work with has been in this place. You're not uniquely bad at this. You're not broken. You're having a completely understandable human response to something that feels scary.

When you're ready to look—and you will be ready—come back to this article. It will help you get through that hard moment of seeing everything clearly for the first time.

For now, if you want to understand what that journey looks like, keep reading. And if you're already at the "I just looked and now I feel terrible" stage, this next part is specifically for you.

The Part Nobody Warns You About

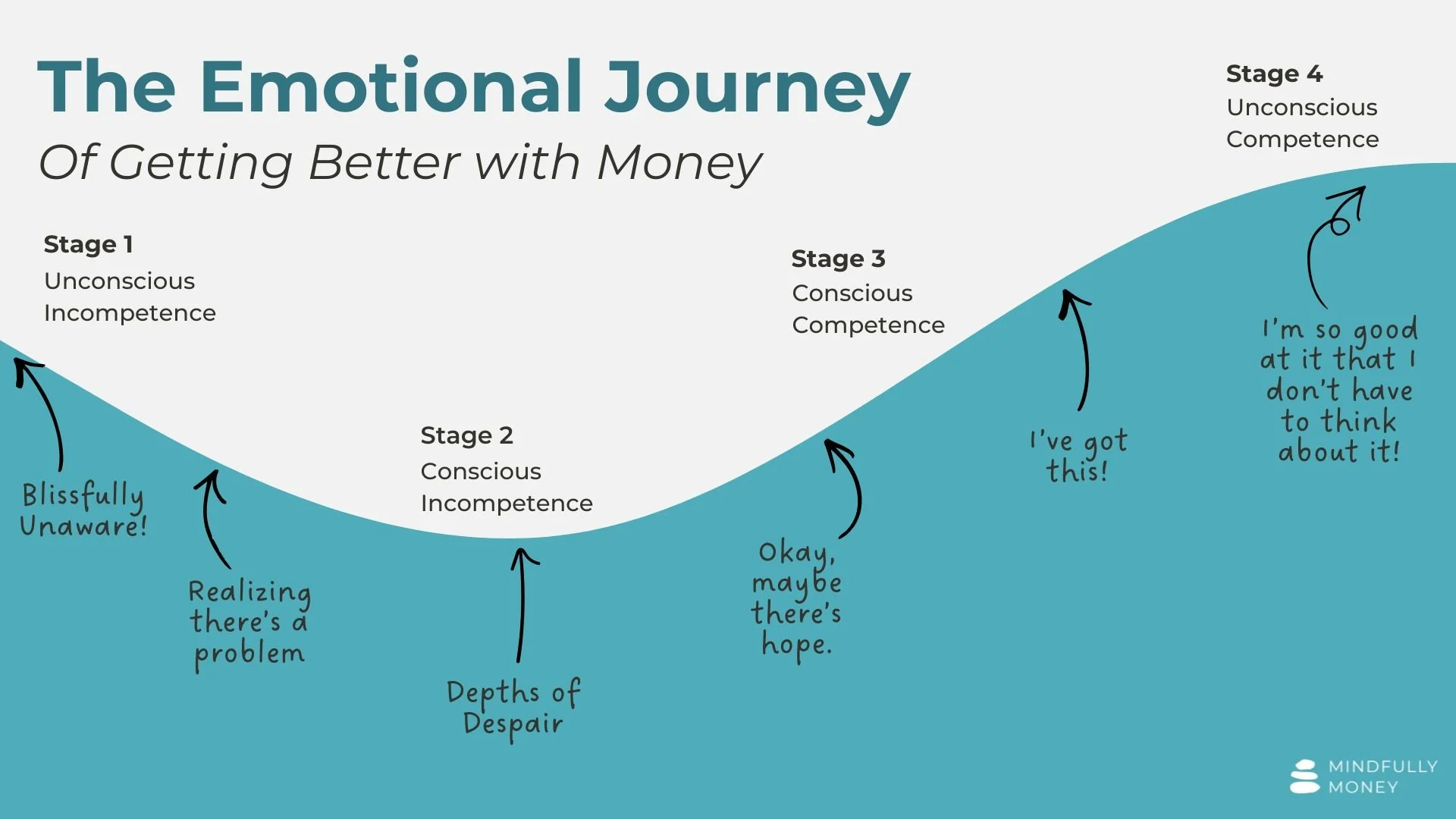

We all want change to work like this: You decide to get better at something, you start learning, and you immediately get better and better until you've mastered it. A nice, clean upward line from "not good" to "good."

But that's not how learning actually works. Not with money, not with anything.

The real process of getting better at something—anything—includes a dip. A period where you actually feel worse about your abilities than you did when you started. You feel this way because now you know exactly how much you don't know, or how big the problem really is.

Think about Elle Woods in Legally Blonde. She gets into Harvard Law School and shows up confident and excited, planning social events in her head and thinking about how it'll be just like undergrad but with her boyfriend back. Then she sits down in her first class with her pink fuzzy pen and heart-shaped notebook, and reality hits her like a truck. Everyone is laughing at her. The professor calls on her and she has no idea what to say. But worse than the external judgment is the internal one—she suddenly realizes just how hard this is going to be.

That moment—when Elle is sitting in class feeling completely out of her depth—is actually progress. She went from not knowing what she didn't know, to knowing exactly what she's up against. It doesn't feel like progress. It feels terrible. But it's a necessary step.

This Happens to Elite Athletes Too

My husband is a high school swim coach, and he sees this pattern constantly. A swimmer comes in having learned to do a stroke incorrectly. But they're strong and determined, so they've had some success with their wrong technique. They're winning races at their current level.

Then they hit a plateau. They can't get any faster with sheer determination—they have to change the way they're doing the stroke.

So the coach works with them on the correct technique. And you know what happens? They get slower at first. Every movement takes mental energy because their body wants to revert to the old way. They go from feeling excited about getting faster to frustrated that the changes aren't immediately working.

But the coach knows something the swimmer doesn't yet: this slower period is temporary. With practice, the new technique becomes natural. And then they don't just get back to where they were—they blow past it.

The same thing is happening with your money. You're in the "getting slower before getting faster" phase.

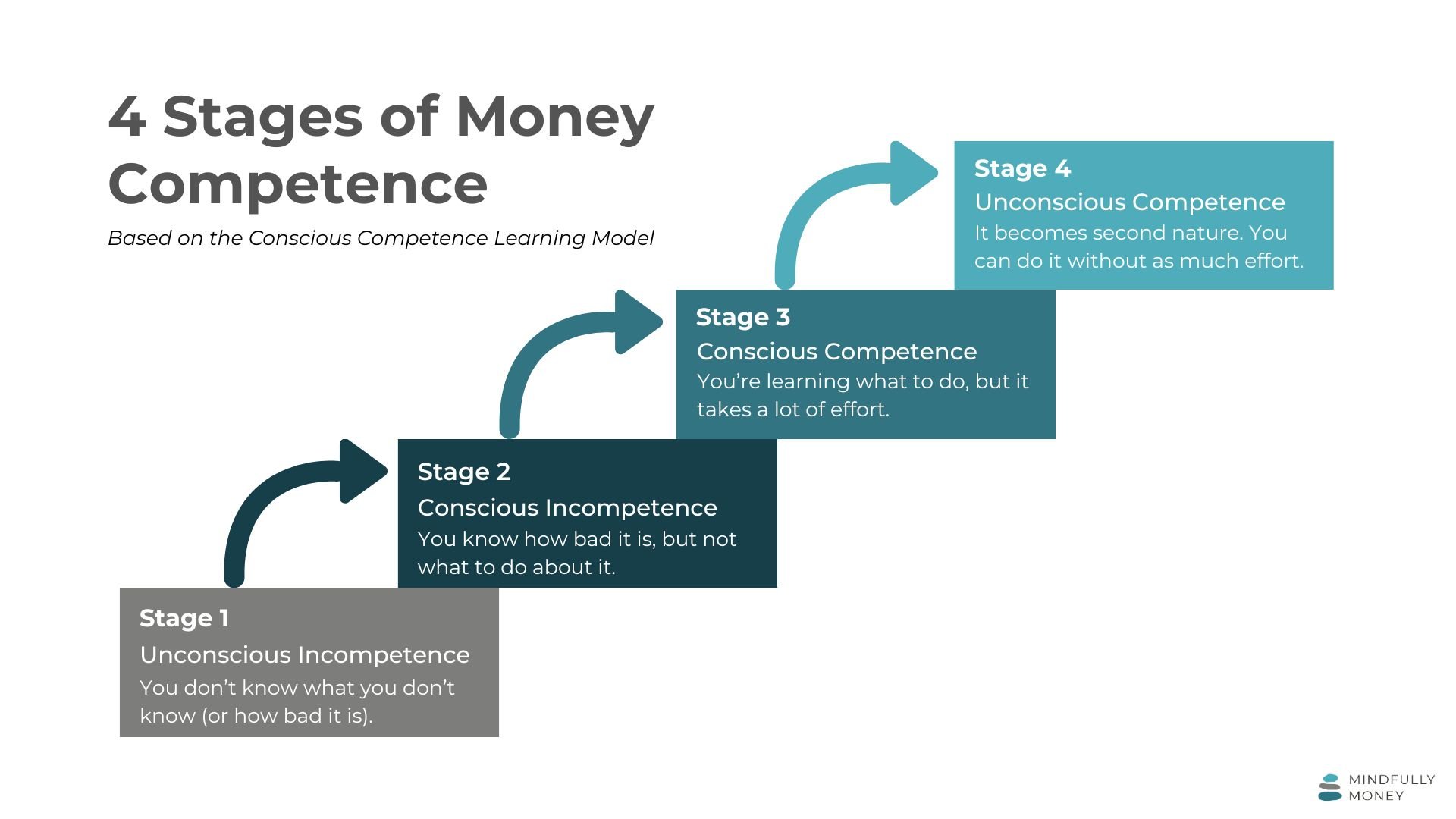

The Four Stages of Getting Better at Anything

Psychologists call this the "Conscious Competence Learning Model" or the "Four Stages of Competence." It applies to everything from learning to drive a car to managing your money better. Here's how it works:

Stage 1: Unconscious Incompetence (You Don't Know What You Don't Know)

This is where most people start when they first come to me for financial coaching. You know something is wrong, but you're not entirely sure what or how bad it is.

You know you have debt, but you haven't added it all up in one place. You know you should be saving more, but you're not sure how much you actually need. You know your spending feels out of control, but you haven't tracked where the money actually goes.

You're aware enough to know there's a problem, but you're avoiding the details because:

You're afraid it's worse than you think

You don't know how to fix it even if you did look

Looking at it feels overwhelming and painful

You're hoping it will somehow get better on its own

This is a completely normal human response. We all avoid things that feel scary or painful. (Think about any time you've had a weird health symptom and didn't want to get it checked out because you were afraid of what the doctor might find.)

The problem is that you can't fix something you can't see clearly. So eventually, you decide to face it. You gather your information, look at your accounts, maybe work with someone like me to get the full picture.

And that's when you move into Stage 2.

Stage 2: Conscious Incompetence (You Know How Big the Problem Is, But Not How to Fix It)

This is the stage you're in right now. And I want you to know: this is the hardest stage.

You've looked at everything. You've seen the full picture. You know exactly how much debt you have, how little you're saving, how much more you're spending than you realized. The numbers are right there in front of you and you can't unsee them.

All the weight of your past decisions is hitting you at once:

Regret about choices you made

Shame about "letting it get this bad"

Embarrassment about what you didn't know

Fear about whether you can actually fix this

Overwhelm about where to even start

You might be thinking thoughts like:

"I should have dealt with this years ago"

"I can't believe I was so irresponsible"

"Everyone else seems to have this figured out—what's wrong with me?"

"This is going to take forever to fix"

"Maybe I should just give up"

Here's what I need you to understand: This stage is painful, but it's not the end. It's the beginning.

I wish I could help my clients skip this stage. I really do. But the truth is that we need this information to move forward. Any attempt to take shortcuts—to avoid the full picture or sugarcoat the reality—just means we might not solve the right problem.

You needed to know exactly what was happening. Now you do. That's actually an accomplishment, even though it doesn't feel like one.

How to Get Through Stage 2 Without Giving Up

The key to making it through this stage is not to wallow in self-punishment, but to practice self-compassion and reframe what's happening.

Instead of: "I can't believe how bad this is"

Try: "I needed this information so I could move forward"

Instead of: "I'm so stupid for letting this happen"

Try: "I didn't have the knowledge or tools I needed, but now I'm getting them"

Instead of: "This will never get better"

Try: "This hard place is not the end—it's the beginning of something new"

Remember: You are not a failure. You are someone who is doing something brave and difficult. You're facing something most people avoid their entire lives. That takes courage.

The painful awareness you're feeling right now? That's not regression. That's progress. You've moved from not knowing to knowing. The next step is moving from knowing to doing something about it.

Stage 3: Conscious Competence (You're Learning What to Do, But It Takes Effort)

This is where Elle Woods starts studying seriously and actually begins to understand the law. She's not effortlessly brilliant yet—she has to work hard, she makes mistakes, she sometimes feels out of her depth—but she's making it happen.

It's where the swimmer has learned the new technique and can do it some of the time, but it takes intense focus not to fall back into old habits.

For you with your money, this is where you start making progress, but it's still hard. You might:

Have a debt payoff plan, but still occasionally overspend

Know your budget numbers, but have to check them constantly

Make better spending decisions most of the time, but still slip up sometimes

Feel hope, but also doubt when things don't go perfectly

This stage is challenging because you're doing better, but change takes practice. You'll make mistakes. You'll have moments where you buy something you later regret and think, "See? I'm never going to get this right."

But here's the truth: One slip-up doesn't mean you're back at the beginning. One moment of weakness doesn't mean you're a failure. Change is a process. The only way to make lasting change is to keep practicing, keep adjusting, and keep going even when it's imperfect.

Every time you track your spending, even imperfectly—progress.

Every time you make a conscious choice about your money—progress.

Every time you don't give up after a mistake—progress.

Stage 4: Unconscious Competence (It Becomes Second Nature)

This is where things finally feel easier. Not effortless—managing money always requires some attention—but easier than it used to be.

It's like learning to drive a car. At first, you have to consciously think about every single thing: which pedal to press, when to check mirrors, how hard to turn the wheel. But after years of driving, you can get in the car and navigate to work while your mind is thinking about your to-do list. The mechanics have become second nature.

For Elle, this is when she becomes a successful lawyer. The basics of legal thinking and practice have become natural to her.

For the swimmer, this is when the new technique is automatic and they're ready to work on the next refinement.

For you, this is when:

You can make spending decisions quickly and confidently

Your monthly money tracking takes minutes instead of hours

You know whether you can afford something without checking every account

You can adjust your plan when life changes without panicking

You'll still be learning and adapting (we all are, always), but the fundamentals will feel natural instead of hard.

Where You Are Right Now

Here’s where you are in the process:

Stage 1: You knew something was wrong, but avoided the details

Stage 2: ← You are here. You see the full picture and it's overwhelming

Stage 3: You'll be learning and practicing, making progress with some setbacks

Stage 4: Managing your money will feel natural and sustainable

You're in the hardest part. The part that feels the worst. The part where most people give up.

But you don't have to be most people.

The Path Forward Starts Right Here

Here's what happens next:

We take all that information you just gathered—all those numbers that feel so overwhelming right now—and we turn them into a plan. Not a vague plan, but a specific, doable plan that fits your real life.

We figure out what needs to happen first, second, and third. We build systems that make the right choices easier. We practice together so you're not doing it alone.

And little by little, you'll move from feeling overwhelmed (Stage 2) to feeling capable (Stage 3) to feeling confident (Stage 4). It may take time, but you’ll get there.

The shame will ease. The fear will quiet down. The overwhelm will become clarity.

But only if you don't give up right now, in this hard middle part.

One More Thing

I know right now it might feel like you'll never get there. Like the gap between where you are and where you want to be is just too big.

But I've walked many women through this exact process. I've seen the moment when it clicks. When managing money stops being this terrifying thing and becomes something you can actually do.

You know what all those women have in common? They didn't quit at Stage 2. They felt all the same feelings you're feeling right now—the regret, the shame, the overwhelm—and they kept going anyway.

Not because they were special or different or better at money than you. But because they understood that feeling worse is part of feeling better. That you have to see the full picture before you can change it. That awareness, as painful as it is, is the first real step toward change.

You're in that first real step right now.

The fact that you're feeling this way means you're doing it. You're facing what most people avoid. You're choosing courage over comfort.

That's something to be proud of, even when it doesn't feel like it.

What Happens Next

If you're working with me, here's what we do from here: We take a breath. We acknowledge how hard this stage is. And then we start building your path forward—piece by piece, step by step, at a pace that works for you.

If you're not working with me yet but you're in this hard Stage 2 place, know that you don't have to stay stuck here. You can either push through on your own (which is absolutely possible—some people do), or you can get support to help you through this part more quickly and with less pain.

Either way, keep going. The hard part you're in right now isn't permanent. It's just a stage. A necessary stage, but still just a stage.

Stage 3 is waiting for you. And after that, Stage 4.

You can get there. You will get there.

You just have to keep going.

Ready to make progress with your money? My 8-Week Money Clarity & Confidence Program is specifically designed to support you through this entire process—from the painful awareness stage all the way to confident independence. Schedule a free consultation call to see if it's the right fit for you.