How to Save Money on Phone, Internet, and Streaming

(Without Cutting Everything)

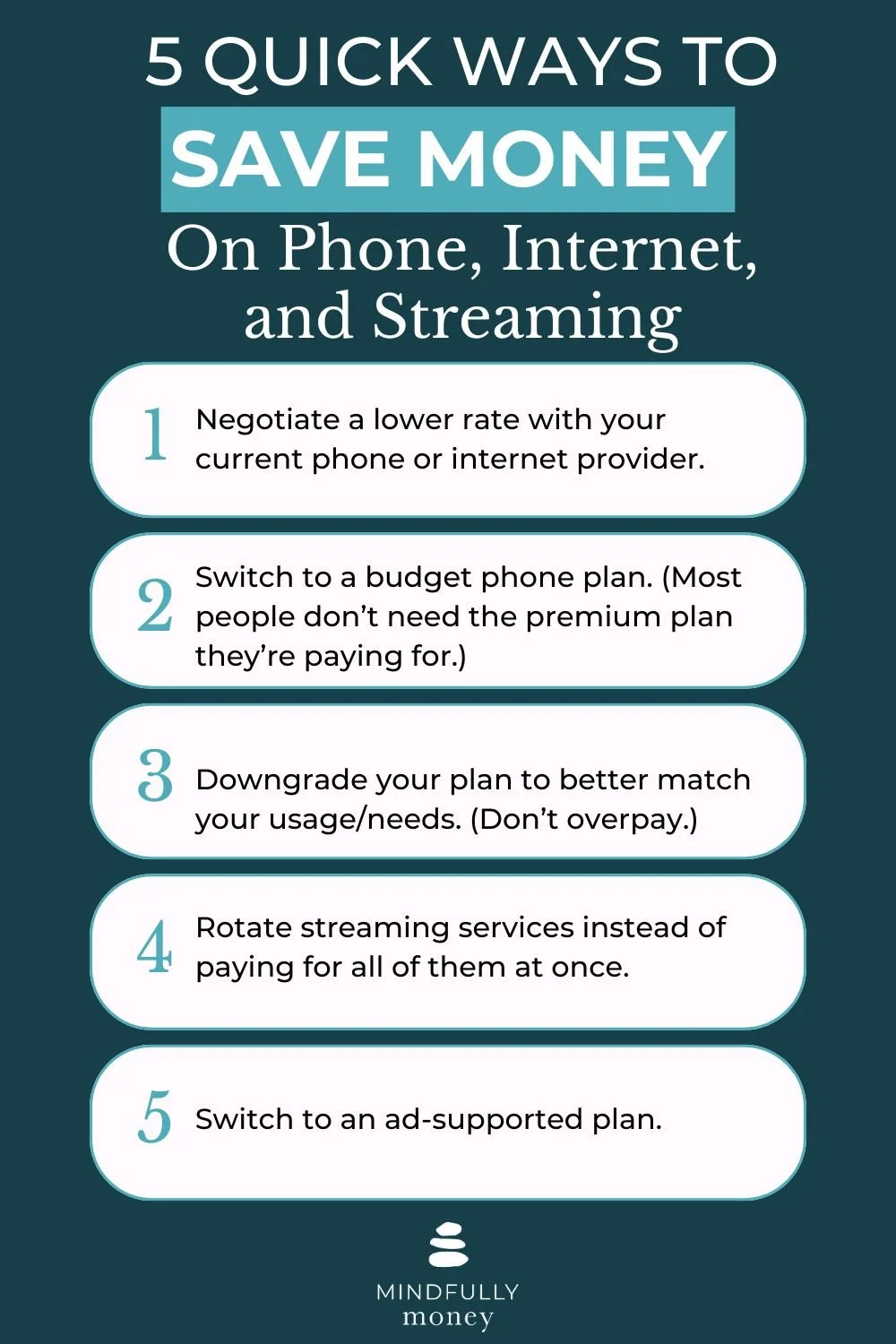

Quick Answer: Most people can significantly lower their phone, internet, and streaming bills by switching carriers, downgrading service to match their usage level, negotiating lower rates, and being more intentional about streaming subscriptions—all without noticing a significant difference in service and quality.

If you're like many Americans, you might be feeling increased stress lately when it comes to your finances. Even though inflation has eased off on certain items, costs of things like health insurance, utilities, vehicles, restaurant meals, and housing have continued to rise, leaving many people wondering how to cut back.

While some costs are hard to change, one of the areas that you do have some control over is phone, internet, and streaming services. These can often add up to hundreds of dollars per month, but most people don't realize how much room there is to reduce those costs without giving up what matters.

The problem isn't that you're bad with money or that you made poor choices. The problem is that these companies are really good at taking advantage of our busy lives.

They offer you a great promotional rate to get you in the door. Then six months or a year later, the price quietly goes up. You're busy living your life—working, parenting, managing a household—and you don't notice. Or maybe you do notice, but you just keep paying because you're not sure what other options you have and calling to negotiate feels overwhelming.

Or maybe you signed up for streaming services one at a time without realizing how much they cost all together. What started as "just Netflix" has become Netflix, Hulu, Disney+, HBO Max, and a few others you're not even sure you still use.

Here's what I want you to know: You don't have to cancel everything and live without a phone or your favorite shows to save money. Small, intentional changes can make a meaningful difference in your monthly bills—without feeling like deprivation. In fact, you might not even notice the difference.

Let me show you how.

Step 1: Get Clear on What You Actually Have (and What It Costs)

The first step is to figure out what services you have, how much you’re paying, and what you’re paying for.

Take 15 minutes and write down:

Every phone line in your household and what you pay monthly

Your internet service provider, plan level, and cost

Every streaming service, subscription box, or digital membership

Any device payments you're still making (phones, routers, cable boxes)

If you haven’t looked at this in a while (or ever), you might experience some regret or embarrassment. Don’t be too hard on yourself—this is extremely common and it’s not really your fault.

Learn More: How to Track Your Spending

Step 2: How Do I Know If I'm Overpaying? Audit Your Usage

Now that you know what you're paying for, it's time to figure out what you're actually using.

This is where most people have their "aha" moment. They realize they're paying for unlimited data but only using 3GB per month. Or they have five streaming services but only watch two of them regularly.

Ask yourself these questions:

For Your Phone Plan:

How much data am I actually using each month? (Check your carrier account—it shows your average usage)

Am I mostly on Wi-Fi at home and work? (Setting your phone to default to wi-fi can reduce your data usage.)

Do I really need unlimited everything?

For Your Internet:

What am I actually doing online? (Streaming? Video calls? Gaming?)

Do I need the fastest speed tier, or would a mid-level plan work fine?

Has my provider raised my rate since I first signed up?

For Streaming Services:

Which services have I used in the last 30 days?

Would I actually miss this if I canceled it?

Am I paying for premium features I don't use (like 4K streaming or ad-free plans)?

Be honest with yourself here. "I might watch it someday" doesn't count. We're looking at what you're actually using in your real life right now.

Step 3: Evaluate Your Options and Make Changes

Now comes the part where you actually save money. You have three main options: switch to something cheaper, downgrade your current service, or negotiate a lower rate.

Option 1: Switch to a Cheaper Provider

For Phone Plans:

If you're consistently using less data than you're paying for, consider switching to a lower-cost carrier or a prepaid plan. Companies like Mint Mobile, Visible, Google Fi, US Mobile, and Consumer Cellular often cost $25-40 per line instead of $70-100+ with major carriers.

The service is often exactly the same (they use the same towers), but you're paying less because you're not subsidizing store locations and extensive advertising.

(I’m currently using a T Mobile prepaid plan for $15/month. I purchased a refurbished and unlocked Samsung Galaxy S23 for under $300 and everything works exactly as I need it to.)

Before you switch:

Check if you still owe money on your phone (you may need to pay it off first)

See if your phone is locked to your carrier

Ask about any promotional credits you'd lose by leaving

What If You Still Owe Money on Your Phone?

This is where people often feel stuck. You know you could be saving a LOT per month, but you still have that phone payment (because carriers want to lock you in and keep you stuck).

If that’s your situation, here are some options:

Option 1: Pay off the phone and switch immediately

Coming up with extra money to pay off your phone might feel like a lot, but it’s usually worth it if you can figure it out. To see if this is an option, figure out how much you owe on the phone and the amount you’d save per month by switching. Be sure to factor in the cost of a new phone if applicable.

How many months would it be before you break even?

After one year, how much would you save?

Remember, if you switch carriers, you may need to either figure out how to unlock your phone to take it with you (this is an annoying step, but is possible) or buy an unlocked phone.

Option 2: Finish paying off the phone, THEN switch

If you don’t have the money to pay off your phone or you have too much left to pay, it might be better to wait until the phone is paid off.

Set a calendar reminder for when your phone is paid off so you don't forget to switch.

Option 3: Check if the new carrier offers switching incentives

Some carriers will help pay off your phone or offer credits when you switch. These deals change frequently, so it's worth checking current promotions. Just read the fine print—sometimes you have to stay for a certain period or the "reimbursement" comes as bill credits over time.

Option 4: Consider selling your phone and buying something cheaper outright

If your phone is worth $500 but you only owe $400, you could:

Sell it for $500

Pay off the $400 balance

Use the remaining $100 toward a refurbished or older model phone ($200-400)

Switch to the $30/month plan

This requires some upfront effort, but can work if you don't need the latest model.

The key question: Will the monthly savings offset what you'd pay to get out of your current situation?

Often the answer is yes—especially if you're currently paying $90-120+ per month for service.

For Internet:

If your area has another provider, get a quote. Even if you don't switch, you can use that competing offer to negotiate with your current company.

For Streaming:

Instead of juggling multiple services, consider rotating them. Subscribe to one or two services, watch what you want, then cancel and switch to another. This alone can save $30-60 per month.

Or switch to ad-supported tiers if ads don't bother you—these are often $5-10 cheaper per month.

Option 2: Downgrade What You Have

Sometimes you don't need to switch companies—you just need to right-size what you're paying for.

Examples:

Drop from unlimited phone data to a 5GB or 10GB plan if that's all you use

Downgrade internet from 1GB speed to 300 Mbps (still plenty for streaming and video calls)

Switch from premium streaming plans to basic plans

Remove premium channels you don't watch

Option 3: Negotiate a Lower Rate

I know calling your internet or phone provider feels uncomfortable. But here's the truth: it often works.

A few years ago, I helped my mom deal with Comcast. They kept raising her rates—she was paying over $190/month for internet and cable. She had just "renegotiated" her contract, and two months later a new $15 charge appeared.

What finally pushed her to act wasn't even the money—it was the frustration of feeling taken advantage of.

After multiple phone calls (because cable companies are skilled at making this difficult), she ended up canceling cable entirely and getting a "price for life" internet-only deal for around $55/month. Combined with a few streaming services, she gets everything she needs for significantly less.

Here's how to negotiate:

Be polite but direct. The person on the phone didn't create the pricing policy. Be kind to them, but be firm about what you want.

Have competing offers ready. "I can get internet for $50/month with [competitor]. What can you offer to keep me as a customer?"

Ask specifically for discounts. "Are there any promotions or loyalty discounts I qualify for?"

Be willing to cancel. Sometimes saying "I'd like to cancel my service" gets transferred to a retention specialist who has more power to offer deals.

Get everything in writing. If they promise a rate, ask for confirmation via email.

*Call center reps are trained to say no or offer you other options that might save you money initially, but cost you more in the long run. Do not let them sell you more things in the interest of saving money.

Things You Actually Use That Are Worth the Cost

Here's something important: Not everything needs to be cut unless you’re in a crisis situation.

If you're using a service regularly and it genuinely adds value to your life, it might be worth keeping—even if it's not the cheapest option.

The goal isn't to deprive yourself of everything you enjoy. The goal is to make sure you're paying for things intentionally, not just out of inertia.

Ask yourself:

Does this service support something I care about?

Would I miss it if it were gone?

Does the value I get match what I'm paying?

If the answer is yes, keep it. If the answer is "I guess?" or "I don't know," that's probably something you can let go.

What to Watch Out For

Promotional pricing that expires. That $40/month rate might jump to $80 after 12 months. Set a calendar reminder to review it.

"Free" phones tied to contracts. You might save $800 on a phone but commit to paying $30 more per month for 24 months. Do the math.

Hidden fees. Equipment rentals, service charges, and taxes can add $10-20 to your bill.

Bundle deals that aren't actually deals. Make sure bundling saves you money compared to separate services.

You Don't Have to Do Everything at Once

If this feels overwhelming, start with just one thing:

Call your internet provider and ask if there's a lower-cost plan

Cancel one streaming service you haven't used in the last 30 days

Check your phone data usage and see if you can downgrade

Keep your current phone for another year instead of upgrading

Even one small change can free up money without sacrificing your quality of life.

Learn More: 10 Practical Ways to Cut Expenses and Save Money

The Bottom Line

Saving money doesn't have to mean cutting joy from your life. It's about aligning your spending with what actually supports your life right now.

You deserve to feel in control of where your money goes—not like companies are slowly draining your account while you're too busy to notice.

Take an hour this week to go through this process. Look at what you're paying for, audit what you're actually using, and make one intentional change.

Future you will thank you for it.

Need help figuring out where your money is going? That's exactly what I help my clients with. In a Financial Snapshot Session, I'll analyze your spending and show you where you have room to cut back without feeling deprived. Learn more here.

Frequently Asked Questions

-

No—most budget carriers use the same towers as major carriers. Mint Mobile uses T-Mobile's network, Visible uses Verizon's, and US Mobile lets you choose between T-Mobile or Verizon. The main difference is usually less customer support and fewer retail stores.

-

Check your contract for:

How much time is left

Early termination fees

Whether the savings from switching would offset the cancellation fee

Sometimes it's worth paying a fee to get out of an expensive contract if the monthly savings are significant.

-

Subscribe to 1-2 services, watch what you want for a month or two, then cancel and switch to different services. Most services make it easy to cancel and restart. You can even use the same email and payment method when you come back.