How to Start a Budget

A Step-by-Step Guide to Creating a Budget That Works for You

Most of us have heard that we should have a budget. But what exactly does that mean—and how do you actually start one that works?

If you’ve ever felt confused, overwhelmed, or resistant to budgeting, you’re far from alone. In fact, reports of how many Americans budget range wildly from around 30% to 80%, depending on how the question is asked. (When you specify a written budget, the number drops significantly.)

At the same time:

83% of people say they overspend or exceed their monthly budget.

50–60% carry a balance on their credit cards month to month.

Yet, 67% believe having a budget would help them reach their financial goals and feel more secure.

So how is it possible that most people believe a budget would help—and even say they have one—but still feel like their money is out of control?

Budgeting Advice Often Misses the Real World

As a financial coach for women, I’ve seen firsthand how confusing, frustrating, and emotionally loaded budgeting can be.

Yes, the economy plays a big role. Childcare, medical costs, rent, groceries — it all adds up fast, and no budget can magically erase those realities. But I’ve also seen how simply having a clear system and a better relationship with money can create real, sustainable change.

So why don’t most budgeting systems work?

1. Budgeting Is Usually Taught Like a Math Problem

Most advice sounds like this: "Add up your income. Subtract your expenses. Done!" But life isn’t lived in a spreadsheet. Your spending changes month to month. Bills come up. You get invited to weddings. You need a new winter coat. Real-life budgeting needs to be flexible and human, not just theoretical.

2. Budgeting Sounds Restrictive (and Kind of Miserable)

If the idea of budgeting makes you think of giving up restaurants, canceling all your subscriptions, or never buying anything fun again, you’re not alone.

You might’ve heard advice like:

“You should only see the inside of a restaurant if you’re working there.”

Your kids should have “two dolls instead of 30.”

Cut out everything except rice and beans.

You just have to tighten your belt.

Stop buying coffee—it’s like “peeing $1 million down the drain.”

It’s no wonder most people avoid budgeting — it sounds like a punishment.

But here’s the thing: You don’t have to restrict yourself to manage your money well.

In fact, the biggest shift for many of my clients is realizing that budgeting isn’t about restriction—it’s about having clarity and being intentional. When you know where your money is going, you can decide what matters most to you and prioritize that.

So, What Is a Budget?

Here’s how I like to define it:

A budget is a system that shows you where your money went — and helps you make intentional decisions about where you want it to go.

That’s it.

It’s not 30 categories of expenses and dividing up every receipt. It’s not tracking every latte. It’s not depriving yourself. It’s about having a plan for your money that actually works for your life.

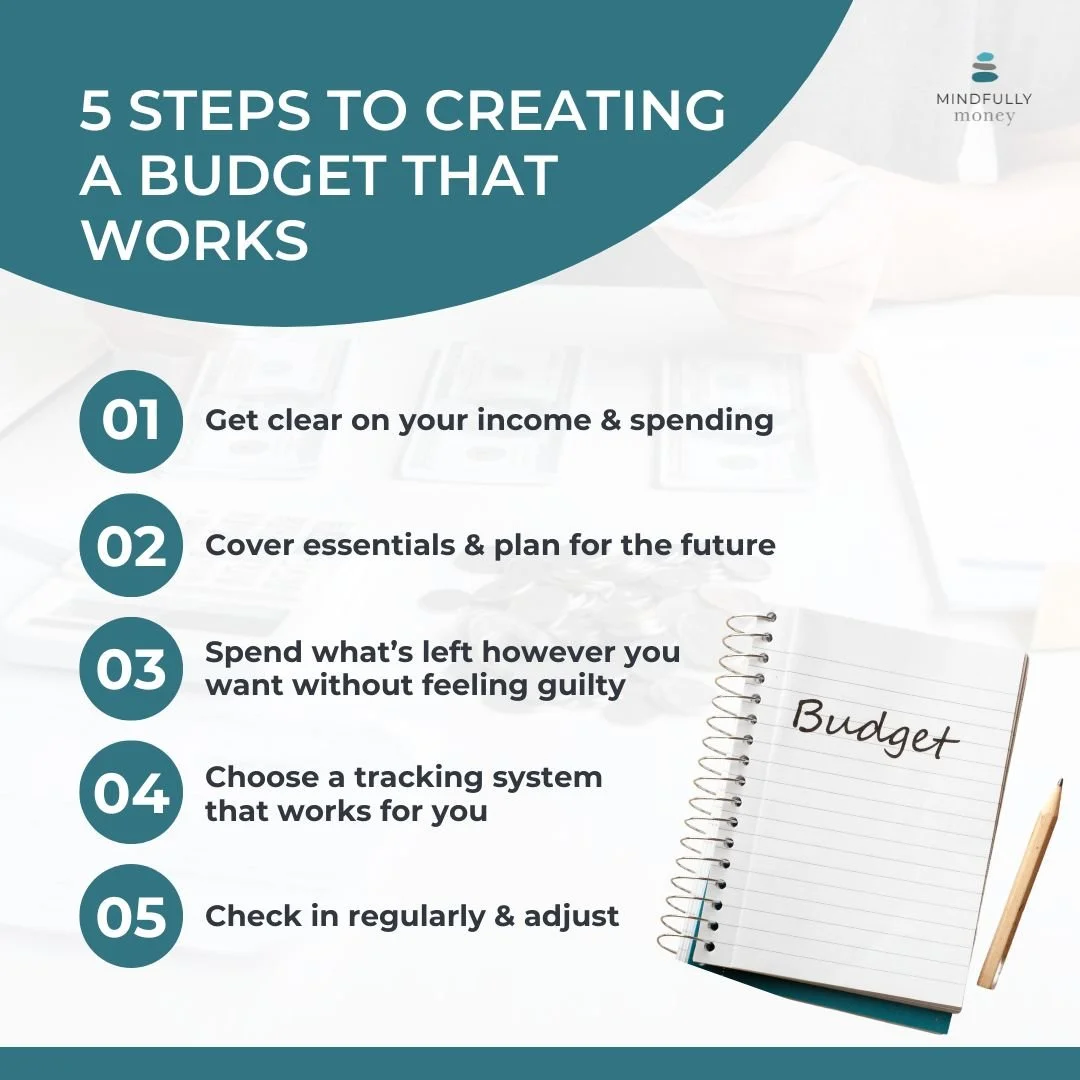

How to Start a Budget in 5 Steps

If you’re starting from scratch, here’s a simple, beginner-friendly process for creating a budget that you’ll actually use.

Step 1: Understand What’s Currently Happening With Your Money

Start by getting a clear picture of:

How much money you have coming in (your take-home pay + any other deposits)

How much money is going out

Where your money actually goes

This is your financial baseline. Even if it’s uncomfortable to look at, it gives you essential clarity—and awareness is the first step to change.

Step 2: Cover the Essentials and Plan for the Future

Once you know what’s currently happening, start building your budget with these key pieces:

How much do you need to pay your fixed bills each month?

How much do you want to save for the future and set aside for upcoming expenses?

How much is left for everything else (flexible spending)?

This step helps you prioritize what must be covered first — so you can plan for the rest accordingly.

Step 3: Spend What’s Left

Whatever’s left over after your fixed bills and savings goals is your flexible spending money. Because you’ve already taken care of your priorities and the things you really need, you get to spend the rest in whatever way makes sense—without feeling guilty about it.

The point of budgeting isn’t to eliminate joy. It’s to spend in alignment with your values and goals.

Step 4: Choose a Tracking System That Works for You

There’s no one right way to budget — the best system is the one you’ll actually use. Try one (or a combination) of the following:

A spreadsheet (Get my free money tracking template.)

Separate checking accounts for different spending areas

Automatic transfers and bill pay

Add Structure If You’re Struggling

Don’t be afraid to keep it simple. Your system should make it easier, not harder, to stay on track.

If you find yourself consistently overspending, consider adding more structure:

Stop using credit cards for now

Use cash for certain categories

Use a separate checking account for variable spending

Set specific spending limits for the week or month

Learn more: How to Track Your Spending

Step 5: Check In Regularly

Think of your budget like a living document. It’s not about being perfect—it’s about building awareness and adjusting as life changes.

Weekly:

Review recent transactions

Look for fraudulent charges or unexpected bills

Check your available balance for the week

Monthly:

Review last month’s spending

Adjust for any overspending or upcoming expenses

Revisit your goals and tweak your savings plan if needed

What Makes a Budget Work?

As we saw from the stats earlier in this article, many people are budgeting without much success. So how do you know if what you’re doing is actually working? Here are the signs of a successful budget:

You actually use it (not just once, but regularly)

It helps you spend less than you earn

It helps you achieve your goals and have money for the things that are most important to you

Final Thoughts: A Good Budget Gives You Flexibility

The goal isn’t perfection. You’re allowed to adjust, splurge sometimes, and have life happen. But when you know what’s coming in and going out — and you have a plan for your money — you gain a powerful sense of agency.

A budget shouldn’t be so rigid that it doesn’t allow you to adjust on the fly, buy more of something when it’s on sale, or prevent you from going out with your friend at the last minute. It’s meant to be a guide that gives you a high level of structure and awareness, but also allows for flexibility. Give yourself a lot of wiggle room. Overestimate expenses. Be conservative with spending (to a point). Keep extra money on hand to cover regular spending fluctuations.

That’s what I want for you. Not just a “budget,” but a relationship with your money that feels clear, doable, and grounded in your real life.