Is It Worth It? 7 Questions to Ask Yourself Before You Buy

Last month, my husband and I spent a thousand dollars on our upstairs bathroom.

Not on beautiful tile or a stunning vanity. Not even on one of those fancy rainfall showerheads. Nope—we spent it on a bathroom fan and an outlet.

I know. Thrilling, right?

But here's the thing: our 100-year-old house didn't have any ventilation in that bathroom. After my teenagers showered, the walls would be dripping with condensation. The humidity would creep out into the hallway, making the stair railing sticky. I kept imagining mold growing inside the walls, the wood slowly rotting away, and a much bigger (and more expensive) problem waiting for us down the road.

We'd been thinking about this purchase for over a year. We tried using fans to move the air around. We opened windows. Nothing really worked. And with two kids in sports taking daily showers, the situation wasn't getting better.

So we hired an electrician, they cut a hole in our roof to vent everything outside, and now we have a boring bathroom fan that works beautifully. Plus an outlet by the sink, which turns out to be life-changing when you're not fighting over the one outlet across the room.

Was it worth it? Absolutely. Was it fun to spend money on? Not even a little bit.

And that's exactly why I wanted to share this story with you.

The Real Challenge of Spending Decisions

If you're like most people I work with as a financial coach, you're probably earning enough money. You're not broke. But somehow, you still feel like you can never get ahead. Maybe you're carrying debt that won't seem to budge. Maybe you look at your bank account and wonder where all the money went. Maybe you buy things and then feel guilty about it, but you're not sure how to stop.

The hardest part isn't that you're bad with money. The hardest part is that every single day, you're faced with dozens of decisions about where your money should go—and nobody ever taught you how to make those decisions with confidence.

Should you buy that thing you've been eyeing? Can you actually afford it? Is it worth it? How are you supposed to know?

Most of us just make decisions on the fly. We see something, we want it, we buy it. Or we agonize over every purchase, feeling guilty no matter what we choose. Neither approach feels good.

Here's what I've learned after years of coaching people through their money decisions: You'll never have enough money to buy everything you want, whenever you want it. None of us will. We all have to make choices.

The secret isn't cutting out everything fun or becoming the next Ebenezer Scrooge. The secret is getting really clear about what actually matters to you, and then making intentional choices that align with those priorities. When you can do that, you can spend money—yes, actually spend it—without the guilt and shame.

A Simple Framework for Better Decisions

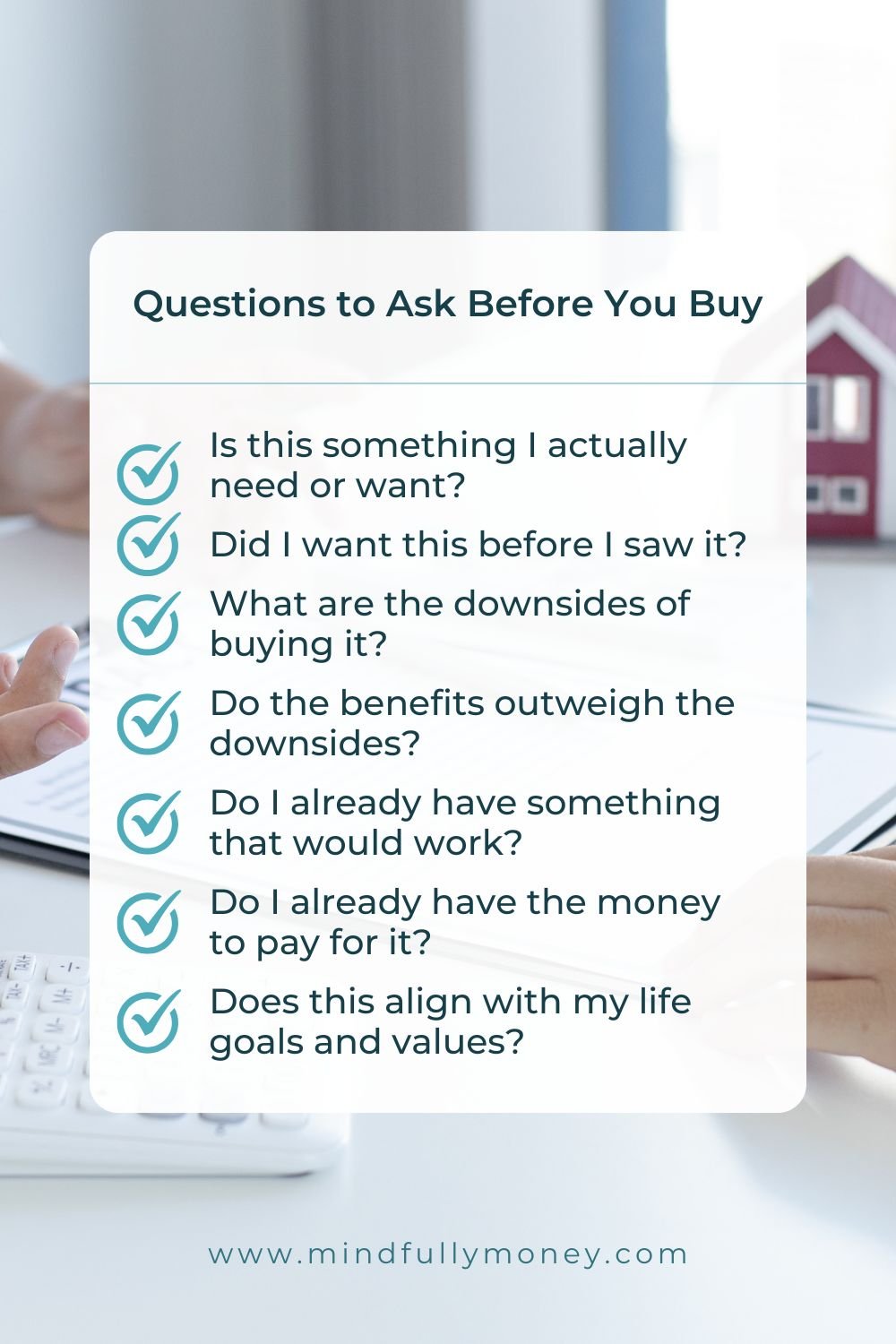

I'm going to share seven questions that will help you evaluate any purchase with more confidence and less second-guessing. These aren't meant to make you feel bad about what you buy. They're meant to help you feel good about your choices—whether that choice is buying something or walking away.

Fair warning: this takes practice. You won't be perfect at it right away, and that's okay. The goal is progress, not perfection.

(Also, these questions are for bigger purchases—the ones that actually matter. You don't need to interrogate yourself every time you buy a $4 item at Target.)

If you want a more structured approach to building these habits over time, my 30-Day Gentle Money Reset walks you through this process with daily prompts and reflections. But for now, let's dive into the seven questions...

The 7 Questions to Ask Before You Buy

1. Is this something I actually need or genuinely want?

Let's be honest: most of us have things sitting in closets, shoved in basements, or collecting dust on shelves that we thought we wanted when we bought them. If you could go back in time, would you still buy those things?

It's perfectly fine—encouraged, even—to buy things you just want. Things that bring you joy, make your life easier, or just make you happy. But there's a difference between genuinely wanting something and wanting the idea of something.

I learned this lesson with my Instant Pot. Everyone raved about how magical it was, how it would change my life. So I bought one. And you know what? It lives in my basement because I don't have room in my tiny kitchen, and honestly, it's usually easier to just cook things the way I always have. The few recipes I do like making in it aren't things I make very often.

On the other hand, my air fryer? That thing is a weeknight hero. I can toss in some chicken strips or vegetables, push a button, and dinner is crispy and ready. On nights when I'm exhausted and don't feel like cooking, it saves me. That was a good purchase.

Try this: Imagine yourself three years from now. Will you be glad you bought this item, or will it be one more thing taking up space?

2. Would I have wanted this if I hadn't seen an ad or sale for it?

This is a big one, and it's tricky because marketing is designed to make you want things you never knew you needed.

A few years ago, Target had SodaStreams on sale for 40% off with an extra canister—for one day only. Suddenly, I found myself dreaming about all the sparkling water I could be drinking. Think of all the cans I wouldn't have to recycle! No more going to Target only to find they're out of club soda!

But here's the truth: I only wanted it because I saw it was on sale. Before that moment, I'd never once thought, "You know what would improve my life? A SodaStream."

Sales create urgency. Ads create desire. Social media makes you think everyone else has something you're missing out on. These are powerful forces, and they work. The question is: are you buying this because you want it, or because someone convinced you that you should?

Learn more about the techniques stores and companies use to get you to buy things here.

3. What are the downsides of buying this?

Every purchase has trade-offs, and we often don't think about them until after we've already spent the money.

With the SodaStream, I thought about having to find space for it in my already-cramped kitchen. I thought about the hassle of tracking down replacement CO2 cylinders. For me, those downsides outweighed the benefits.

With the bathroom fan, the downside was spending a thousand dollars on something boring. But the alternative—potential mold, damaged walls, a bigger repair bill later—made that trade-off worth it.

Sometimes the downside is financial: you won't be able to afford something else you want. Sometimes it's practical: the item requires maintenance, space, or time. Sometimes it's emotional: you might feel guilty about spending the money.

Name the downsides honestly. They don't automatically mean you shouldn't buy it—but you should go in with your eyes open.

4. Do the benefits outweigh the downsides?

This is where you weigh everything you've thought about so far.

For my family, drinking sparkling water occasionally doesn't justify the hassle and space of a SodaStream. But for a family that goes through cases of La Croix every week? The benefits might absolutely be worth it.

For us, the bathroom fan was an easy yes. The benefits—protecting our home, reducing humidity, having an outlet where we actually need it—far outweighed the cost.

There's no universal right answer here. It's about what makes sense for you and your life.

5. Do I already have something that would work?

Before you buy something new, take a minute to think about what you already own.

Feeling like you need to refresh your home decor? Try rearranging what you already have first. Move things from one room to another. Dig through that box of stuff you put in storage when you got tired of it last year—it might feel fresh again now.

Thinking you need new workout clothes? Check the back of your drawer. I bet there's something in there you forgot about.

We live in a culture that constantly tells us we need the new thing, the better thing, the thing everyone else has. But sometimes, what we already have is enough. And recognizing that can save you money and help you appreciate what you already own.

Read More: Why We Want More and How to Find “Enough”

6. Do I actually have the money to pay for this right now?

This is non-negotiable for me, and I know it might be the hardest question on this list.

If you don't have money in your bank account right now to pay for something—and I mean cash in the bank, not just available credit—you shouldn't be buying it.

I know that's blunt. But here's why it matters: when you spend money you don't have, you're borrowing from your future self. You're making a choice that your future self will have to deal with, often with interest payments on top.

The only exceptions are true emergencies related to survival: medical care, medications, food, urgent home repairs that affect safety. In those cases, a credit card might be necessary. But that's exactly why building an emergency fund—even a small one—is so important. It gives you options when life throws you a curveball.

If you're struggling to know whether you can afford something, or if you're tired of feeling anxious about money decisions, that's something a financial coach can help with. Sometimes you just need someone to help you design a system that works for your life and gives you clarity.

7. Does this align with what I actually want my life to look like?

This is the big one. The question that ties everything together.

You have values, whether you've consciously thought about them or not. You have a vision for what you want your life to feel like, what brings you joy, what matters most. When your spending aligns with those values, you'll feel more satisfied—even if you're spending less overall.

The catch is that managing money means making choices. You can't have everything. But when you get clear on your priorities, you can cut back on the things that don't matter much to you and spend more freely on the things that do.

Let's talk about the infamous latte example, since personal finance gurus love to villainize coffee.

Say you buy a $5 latte every workday. That's about $1,300 a year. Not an insignificant amount.

Now, if that daily latte makes your morning commute more bearable, if it's a small moment of comfort in your day, if it genuinely brings you joy—and you have the money to pay for it without sabotaging other financial priorities—then buy the latte. Seriously. Enjoy every sip.

But here's the question worth asking: What am I giving up in order to buy these lattes?

Maybe that $1,300 could pay for an extra vacation day. A nicer hotel on a trip. A few special experiences with your kids. A dent in your debt. A bigger emergency fund so you can sleep better at night.

If the lattes matter more to you than those other things, great! That's an intentional choice, and you can feel good about it.

But if you'd actually rather have the vacation or the peace of mind—if the lattes are just a habit you don't even enjoy that much anymore—now you have information you can act on.

This isn't about judgment. It's about getting clear on what truly matters to you and making sure your spending reflects that.

Not sure what your values are? Check out my free values guide to help you gain clarity.

It's About Making Intentional Choices

Here's what I want you to understand: going through these questions might still lead you to say yes to a purchase. And that's not just okay—it's great.

You absolutely should use your money in ways that are fun, that increase your enjoyment, that make your life better. Money isn't just for responsible adulting and protecting your future. It's also supposed to bring you joy and ease in the present.

Buying things isn't inherently bad. These questions aren't designed to make you feel guilty or stop you from spending. They're designed to help you make intentional decisions so that you can spend money confidently, without the guilt and shame that come from impulsive choices you later regret.

When you're intentional about your spending—when you've thought it through and made a conscious choice—you get to enjoy what you buy without the nagging voice in your head questioning whether you should have done it.

That's the goal. Not perfection. Not deprivation. Just more confidence, less guilt, and spending that actually aligns with the life you want to build.

Ready to Make Better Spending Decisions?

These seven questions are just the beginning. If you want to go deeper, I've created a free downloadable list of even more questions to help you think through bigger purchases. Print it out, keep it handy, and reference it whenever you're facing a spending decision that has you second-guessing yourself.

Download the complete list of smart spending questions here and start making choices you can feel truly good about.

Want to Go Deeper?

These seven questions are just the beginning. If you're ready for a complete transformation in how you think about and manage money, check out The Gentle Money Reset—a 30-day guided journey with daily reflections, tracking tools, and compassionate prompts to help you build lasting habits. It's like having a financial coach in your pocket for a month.

Remember: you're not bad with money. You just need a framework for making decisions that works for you. And now you have one.

Pin this for later: