How to Make Your Budget More Flexible (So You Can Actually Stick to It)

Have you ever planned out every dollar in your budget, only to feel like you “messed up” the moment something didn’t go according to plan?

Or maybe you found a great deal on coffee or toilet paper and wanted to stock up—but weren’t sure how that would fit into your carefully planned budget.

If that sounds familiar, I want you to know:

It’s not that you’re bad at budgeting. Most budgets are simply too rigid to begin with.

We’re told to account for every cent. To stick to the plan. To be in total control.

But real life doesn’t work that way. Life is messy and full of surprises—good and bad.

You want to have the freedom to:

Stock up on essentials when they’re on sale

Replace worn-out sneakers when they finally give out

Buy birthday gifts or respond to spontaneous needs without guilt

And with rising costs, it’s becoming even harder to stick to a budget that’s too precise.

So what’s the solution?

It’s not about “planning better” or “just having more discipline.” It’s about building more flexibility into your budgeting system. You need enough structure to stay on track—without making things so rigid that they’re impossible to follow.

Let’s talk about five ways to do just that.

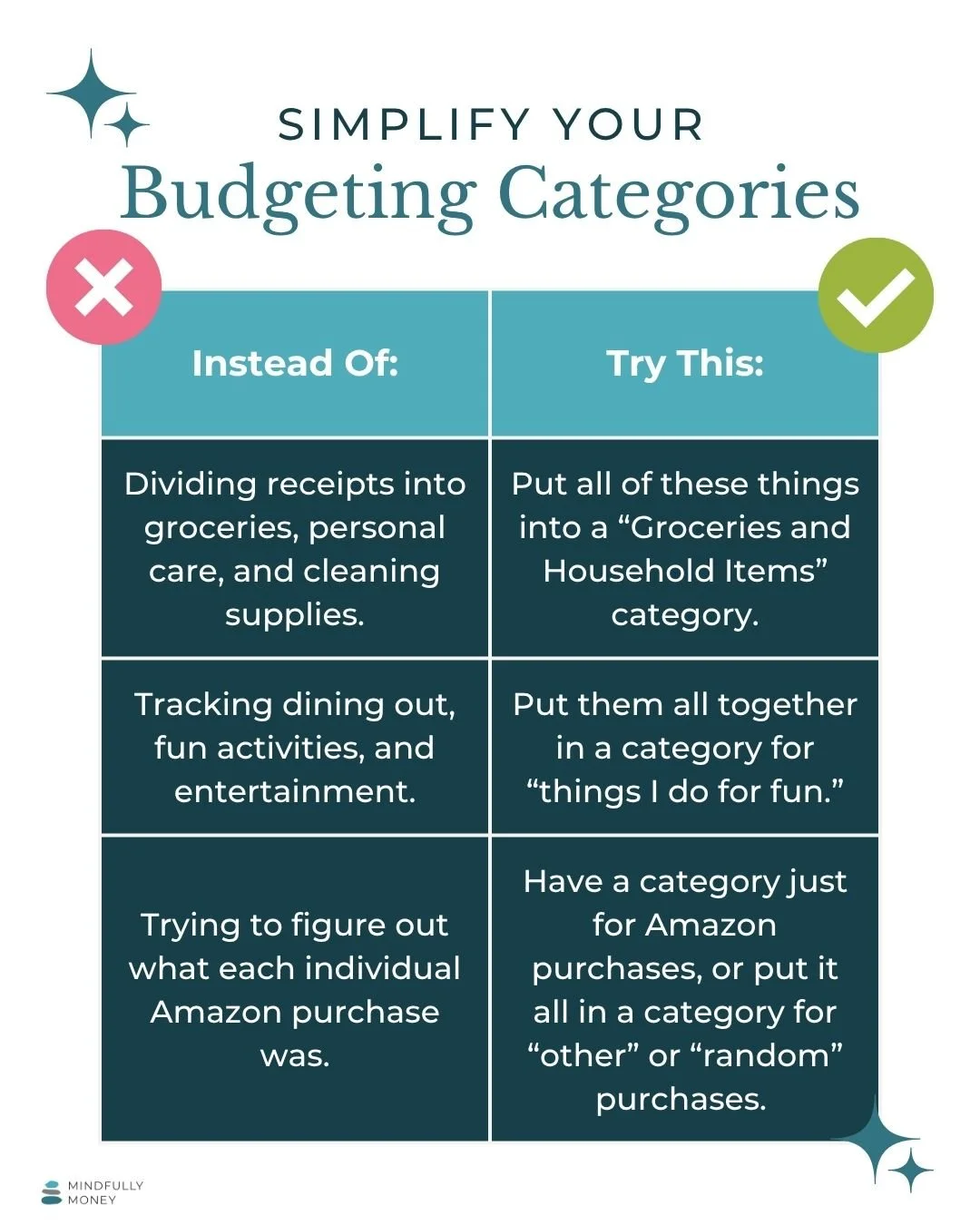

1. Use Broader Budget Categories Instead of Tracking Every Detail

If you’ve ever felt overwhelmed trying to separate a single Target receipt into eight different categories, you’re not alone.

That level of precision might work for some people, but for many, it leads to stress, decision fatigue, and burnout.

It can also make you feel like you’re failing when things don’t fit perfectly.

Instead, try using a few broad, practical categories. For example:

Groceries & Household Supplies

Lump together food, cleaning products, paper goods—all those Target or Costco runs.Eating Out & Fun Activities

Let’s be honest—eating out is fun, and it often goes hand-in-hand with things like concerts, movies, or sporting events.Random Spending

This could include Amazon purchases, clothing, hobbies, or impulse buys.

You don’t need 20 budget categories to be intentional and you don’t even have to use the categories I suggested.

Figure out a setup that works for your brain—one that gives you useful information without dragging you down in details.

Note: If detailed categories work well for you, that’s totally okay. Sometimes it’s helpful to have more detail, especially if you’re trying to reduce spending. But if you’re getting bogged down or burned out, it may be time to simplify.

2. Plan for What You Can’t Plan

It might sound strange, but one of the most important things you can plan for… is that your plans won’t go perfectly.

There will always be:

Last-minute birthday gifts

Medical bills or copays

A car or appliance repair that comes out of nowhere

This is especially true if you’re a homeowner—something will eventually break, and you often won’t know when or how much it’ll cost.

Build in a line item or category for:

“Unexpected”

“Just in Case”

“Life Happens”

Even $50–$100 per month can give you breathing room and reduce stress when surprises show up.

Bonus tip: For large or unpredictable expenses (like home maintenance), consider setting up a separate savings bucket. (See #5 below.)

3. Keep a Buffer in Your Checking Account

This one is simple but powerful: don’t let your bank account hit zero.

Choose a minimum balance to keep in your checking account—and treat it like it’s not even there.

Even $50 or $100 can provide peace of mind, but ideally, aim to keep at least one paycheck’s worth as a buffer. That way, you always have enough to get through the time between paychecks.

Yes, you can count this as part of your emergency fund—as long as you don’t touch it for everyday expenses.

This kind of buffer protects you from:

Overdraft fees

Unexpected timing issues with bills

Last-minute purchases that throw your budget off

You’ll be amazed at how having a little extra in your account can reduce stress and worry.

4. Overestimate Your Expenses to Add Wiggle Room

One of the biggest reasons people blow their budgets?

We underestimate how much things actually cost—or how much we actually spend.

As a financial coach, I’ve seen this with nearly every client I work with.

(And honestly? It happens to me too.)

Sometimes it’s because prices have gone up. Sometimes we forget things.

Sometimes it’s just that life doesn’t fit neatly into round numbers.

And sometimes it’s just they way our brains work—how we perceive things (especially how much we spent) is often different than reality.

So instead of budgeting $200 for groceries when you usually spend $220, give yourself some cushion. Budget $230, or at least overestimate by 10%.

This helps you avoid that “I failed again” feeling when numbers don’t match perfectly—and makes your budget more realistic.

Not sure where your money goes or how much you spend? Learn how to start tracking your expenses here.

5. Use Savings Buckets for Irregular or Seasonal Spending

Even if you don’t know exactly what will come up, you can anticipate a lot of irregular expenses.

You know:

Holidays are coming

You’ll eventually need new clothes

Someone will have a birthday

You’ll probably go on a trip or vacation

Rather than scrambling when those things arrive, start setting aside money now—a little at a time.

Create labeled savings buckets for:

Holidays

Back-to-school

Car maintenance

Travel

Clothing

Home repairs

Once you know your annual total for each category, divide it by 12 and save that amount monthly. Overestimate by 10% if you can.

And if that feels like too much?

Start with what you can afford now—even if it’s just $10/month—and increase it over time.

Read More: How to Use Sinking Funds (Savings Buckets)

A Final Note of Encouragement

If you’re thinking, "This all sounds great, but I barely have enough to cover my basic expenses right now,"—I see you.

Creating flexibility in your budget takes time. You don’t have to overhaul everything at once.

Maybe you just:

Start with one broader spending category

Add a $25 “Just in Case” line

Keep an extra $50 in your account this month

Even the smallest bit of wiggle room can help you feel more in control, more confident, and less stressed.

And if you’ve never experienced what it feels like to have breathing room in your budget—know that it’s possible.

You deserve a money system that supports you, not one that makes you feel like you’re always behind. You deserve to feel safe, capable, and calm with your finances.

And if you want support creating a flexible, personalized money plan that actually works for your life—that’s exactly what I help my clients do.