A Complete Guide to Your Credit Score

Credit scores may be one of the least interesting topics you could ever want to explore, but understanding how credit scores work can give you access to loans, better interest rates, better prices on utilities, and even jobs.

If you know what all the terms mean and just want to know the four most important things in managing your credit, scroll all the way to the bottom.

What is a credit score?

A credit score is a number that lenders use to determine how likely it is that you will pay your bills and repay money that you borrow. Typical credit scores range from 300 to 850. A higher credit score indicates that you are more likely to pay your bills and repay your debts.

The system was developed as a way for banks and other lenders to determine when it is “safe” to lend money. Instead of having to look through a potential borrower's entire credit history, a lender can look at your credit score.

How is your credit score determined?

Credit scores are based on your credit history as detailed in your credit report. Your score is made up of several factors, including:

Your loan and credit card payment history

Your credit utilization ratio (how much of your available credit you use)

The length of time you’ve had and used credit

The number of hard inquiries that have been made (such as when you apply for a new credit card or loan)

The number of accounts you’ve opened and the age of your accounts.

The types of credit you use

It is important to note that these factors can affect your credit score in different ways. By far the two most important factors are your history of making on time payments and your credit utilization ratio (discussed below).

Credit scores are typically calculated using formulas either from FICO or VantageScore.

What’s a credit report?

A credit report is a detailed summary of your credit history. It contains information about your credit accounts, including what type of accounts you have, your payment history, and any negative marks, such as late payments or bankruptcy.

Your credit history is reported by the major credit reporting agencies (or credit bureaus): Experian, Equifax, and Transunion. These agencies collect your credit history and compile a report for each person.

Note: different agencies may have different information. It’s a good idea to review your credit report from each of the three agencies at least once per year. You can safely request your credit reports by going to www.annualcreditreport.com. Always verify this web address before entering your information, as there are many scammers and look-a-like sites trying to steal your information.

Is your credit score important?

Your credit score can have a big impact in certain areas of your life. A high credit score gives you access to more credit/loans and better interest rates.

For example, if you need a mortgage, a better credit score gets you a lower interest rate, meaning that the cost of borrowing to pay for your home will be lower and more affordable. But if you don’t have a good credit score, you’ll have a higher interest rate. Or, you might not even be able to get a mortgage because banks won’t trust you to make your payments.

Credit scores are used in other ways too. Some employers look at your credit history when you apply for a job. Landlords, cell phone companies and utilities sometimes look at your credit score because they want to know if you will pay your bills.

(There is a question of whether or not this is ethical as it sometimes unfairly denies services (or makes them more expensive) to people who actually are trustworthy. For example, in December 2022, newly elected congressman Maxwell Frost was denied an apartment because of a low credit score even though he is clearly going to be earning enough to pay his rent. People of color are disproportionately affected.)

On the other hand, there are those who say credit scores are only for people who love being in debt. Dave Ramsey, for example, will help you learn how to live without a credit score at all.

So, yes, it can be done, but it is becoming increasingly difficult to do so and there is no shame in taking advantage of things like mortgages and auto loans to strategically buy things you can afford. Out of touch rich people may be able to pay in full for everything they want, but that’s not the reality for most people. If you want to buy a home, you likely need a mortgage.

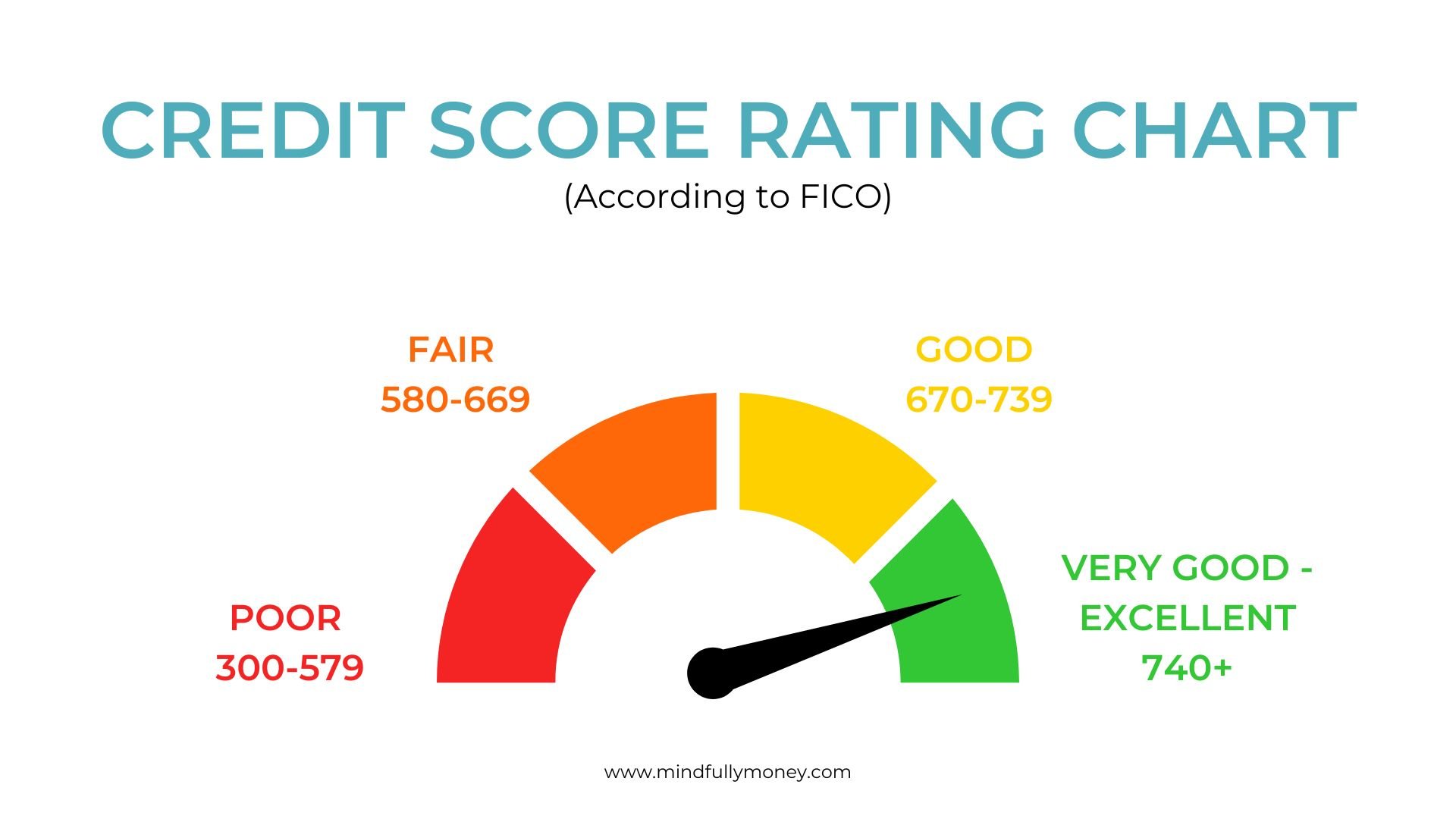

What is considered a good credit score?

If you search Google, you’ll find discrepancies between what is considered a good vs very good vs excellent credit score. This is because lenders don’t all follow the same system or have the same standards. Your credit score will even vary depending on which credit reporting agency is used.

So it’s important to note that there will always be some variation in your credit score.

That said, higher numbers are better. Generally speaking, scores of 740 or higher are considered to be very good or excellent and credit scores of 670-739 are considered good. Anything below that is fair or poor.

How can I improve my credit score?

The two most important things you can do to maintain or improve your credit score are:

Pay your credit card and loan payments on time. Missed or late payments are a major signal that you can’t be trusted with debt, so they have a big impact on your credit score. (Click here to learn more about paying your credit card in full and on time.)

Keep your credit utilization rate under 30%. Your credit utilization rate is the percent of available credit that you use. For example, if you have one credit card that has a limit of $1000, you would want to keep your outstanding balance to $300 or less. ($300/$1000=30%). Credit card companies think that if you’re using the entire $1000, you’re struggling with money and are therefore less likely to be able to pay your bills.

You should also avoid closing too many cards as your payment history could be shortened if you do so, and opening or applying for too many new accounts at one time.

How do I establish credit in the first place?

Credit is established by creating a history of on-time payments on loans or credit cards. So what happens if you don’t have any loans and have never had a credit card?

If you’ve never had a loan and are trying to establish credit, you should first sign up for a credit card specifically for those trying to build credit. Certain starter credit cards have low limits and are designed for students, immigrants, or anyone else who doesn’t have a credit history.

Secured cards require a deposit and are a good option for those who have a bad credit score or are otherwise ineligible for a starter credit card.

Another option for students is to become an authorized user on a parent’s card or to get a co-signer.

The key is to make sure that the card’s payments will be reported to the credit bureaus so you have a recorded history of making payments. Always pay the full amount due before the due date every single month.

Why did my credit score go down?

Credit scores can drop for a number of reasons. It’s possible that you:

Opened a new credit card or took on a new loan. Each new “hard” inquiry into your credit history can affect your credit score for a period of time.

Missed or made a late payment.

Used more of your available credit. For example, you booked a large trip and your credit utilization ratio went up.

Your credit limit decreased or you closed a credit card.

You declared bankruptcy.

There’s misinformation on your credit report (see below for tips on this)

Credit scores fluctuate and it’s important not to get too caught up in the exact number. As long as you stay on track, aren’t missing payments or declaring bankruptcy, and generally stay in the good to excellent range, a minor fluctuation shouldn’t be a big deal.

How can I check my credit score for free?

To check your credit report (which you should do regularly), go to www.annualcreditreport.com and fill out the information. Do not use any other site to request your credit report!

To find out what your credit score is, you have several options. First, banks and credit card companies are increasingly giving you access to your credit score for free. Check your online account to see if your credit score is listed.

If not, credit scoring companies like Credit Karma contract with credit reporting agencies to give you access to your score. Do some research to make sure that the company is reputable before requesting your information.

Protecting Your Credit Score

Credit is one area that is often targeted in identity theft, so it’s important to always make sure you’re working with reputable agencies when providing personal information. Don’t respond to or click on links in emails.

Pin this image to save for later!

To further protect your personal information, you should regularly review your credit report for unauthorized uses, report theft or inaccuracies immediately, and consider putting a freeze on your credit.

Key Takeaways

Managing your credit can feel overwhelming at first as you try to make sense of all of the terms and figure out what you’re supposed to do, but it isn’t actually that complicated once you get the hang of it. The key things to remember are:

To have good credit, you need to have a history of using credit responsibly.

Pay your credit card bills in full and on time.

Keep the outstanding balance on your credit card at 30% or less of your credit limit.

Protect yourself by regularly checking your credit report at www.annualcreditreport.com.