Why Can't I Stop Spending Money? (It's Not What You Think)

You just checked your bank account and your stomach dropped.

Again.

You promised yourself this month would be different. You had good intentions. But somehow you're right back here—staring at transactions you barely remember making, feeling that familiar wave of shame wash over you.

You're smart. You're capable. You manage so much in your life successfully. So why can't you get this right?

What is wrong with you?

Here's what I need you to know first: There's nothing wrong with you.

I know that might be hard to believe right now, but stay with me. What you're experiencing isn't a character flaw, a lack of willpower, or proof that you're "bad with money." It's actually just how human brains work—and once you understand what's really happening, you can start to change it.

Why Do I Keep Overspending? The Real Reason

Have you ever driven somewhere and suddenly realized you don't remember the last few turns? Or opened your phone to check something specific, only to find yourself scrolling an app you didn't even mean to open? (This happens to me all the time.)

This is your brain on autopilot—and it's completely normal.

As adults, we operate on autopilot most of the day. We take the same routes, buy the same groceries, and follow the same patterns without even thinking about it. We don't even consciously decide anymore—we just do it.

Our days are full of routines and habits that run in the background, saving us time and mental energy. And that's usually a good thing.

But sometimes, those habits lead us to spend money in ways we don't intend.

Think about it: Have you ever...

Added something to your cart during a stressful day "just to browse," then completed the purchase without really deciding to?

Stopped by Target for one thing and walked out with a full cart?

Subscribed to something during a free trial and forgotten about it until you saw the charge?

Treated yourself after a hard day, then felt guilty about it later?

These aren't failures. They're habits. And habits are powerful.

The Science Behind "Mindless" Spending

Psychologist Wendy Wood, author of Good Habits, Bad Habits, has found that about 43% of what we do every day is automatic—repeated in the same context while we're thinking about something else.

Read that again: Nearly half of your daily actions are habits, not conscious choices.

Your brain creates these shortcuts because it has to. Can you imagine if you went to the store and had to analyze every single item, comparing it to the items around it and deciding if it's the best version at the best price? Every time? It would be impossible.

That's why we shop at the same stores, buy the same brands, and assume that anything on sale is a good deal. Our brains are designed to default to what's familiar and easy. It's an adaptation that helps us function when we're already making countless decisions every day—managing work deadlines, family responsibilities, or just trying to keep up with everything on our plate.

But these shortcuts can also lead us to do things that aren't in our best interest—like overspending without realizing it.

Read More: Why We Want More and How To Find “Enough”

The Two Systems That Control Your Spending

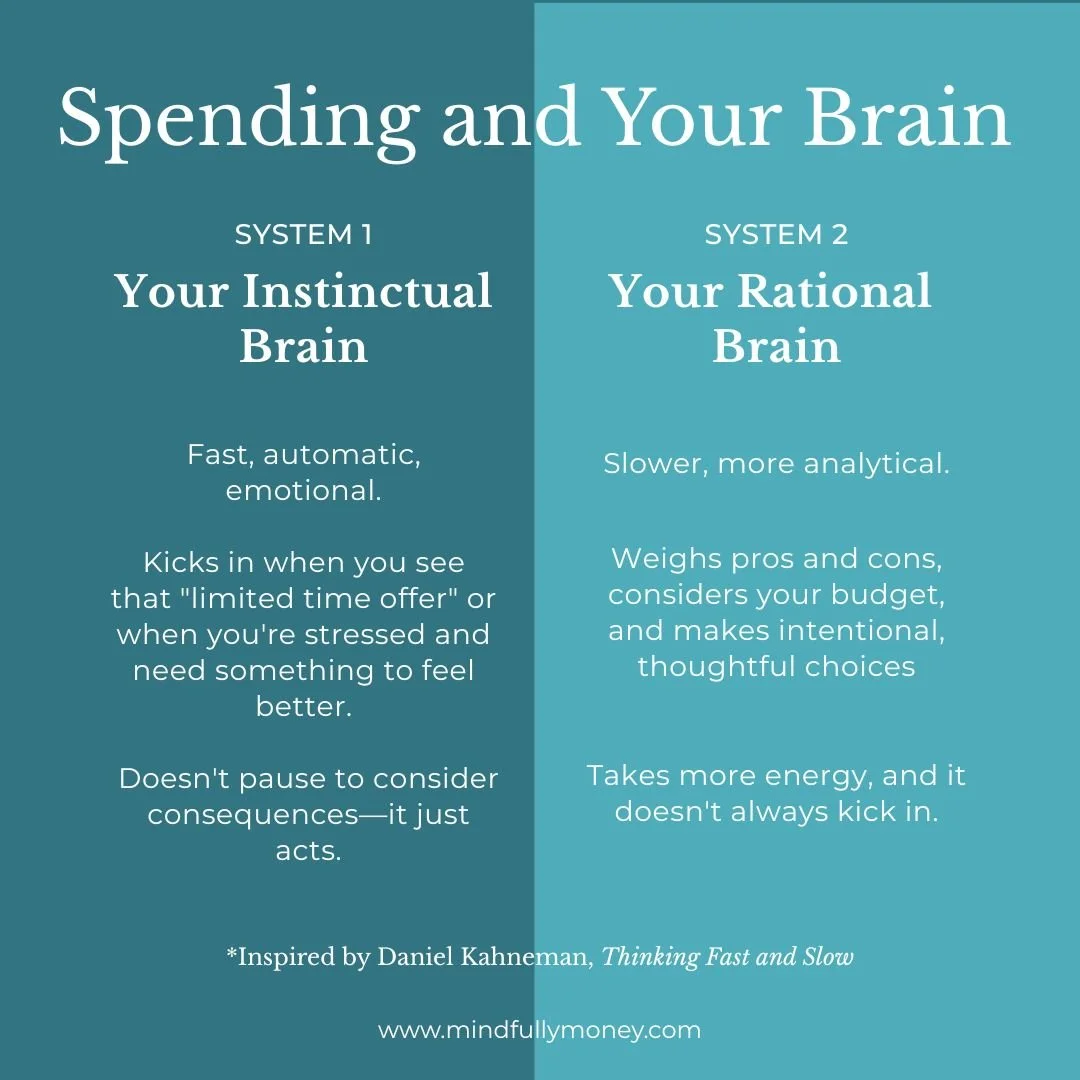

Behavioral economists, such as Daniel Kahneman, have theorized that we have two systems of thinking:

System 1 (Your Instinctual Brain): Fast, automatic, emotional. This is what kicks in when you see that "limited time offer" or when you're stressed and need something to feel better. It doesn't pause to consider consequences—it just acts.

System 2 (Your Rational Brain): Slower, more analytical. This is the part that can weigh pros and cons, consider your budget, and make intentional choices. But here's the problem: it takes more energy, and it doesn't always kick in.

When you're tired, stressed, or distracted (which, let's be honest, is most of the time), System 1 is running the show. That's why you can fully intend to stick to your budget, but still end up with purchases you didn't plan for.

You're not lacking self-control. Your instinctual brain is just faster than your rational one.

Why Personal Finance Advice Makes You Feel Worse

It’s normal to feel frustrated or ashamed when you overspend. Many personal finance “experts” tell you that spending too much money is a personal problem—that you made stupid decisions, didn’t know better, are bad with money, or lack self control.

But that's not true, and it's not helpful.

Struggling with money is not a personal failing. It's not a lack of knowledge or willpower—it's just how our brains work. Plus, many financial struggles stem from external circumstances beyond any one person's control: stagnant wages, rising costs, unexpected emergencies, systemic inequalities.

The shame you feel? It's not because you deserve it. It's because you've been told over and over that this should be easy, that everyone else has it figured out, and that your struggle means something is wrong with you.

Nothing is wrong with you. You just need a different approach.

How to Change Your Spending Patterns (Without Shame)

If you'd like to spend more intentionally—not because you "should" but because you want to feel more in control—here are steps that actually work. These aren't about willpower or restriction. They're about working with your brain instead of against it.

1. Identify Your Patterns (With Curiosity, Not Judgment)

You might already know that certain stores, situations, or emotions trigger spending for you. Maybe it's stress shopping after work. Maybe it's mindless scrolling that turns into purchasing. Maybe it's the "I deserve this" moment after a hard week.

If you're not sure what your patterns are, try keeping a simple spending diary for a week or two. Write down:

What you bought

Where you bought it

The amount

How you were feeling or what prompted the purchase

Your instinct might be to avoid this because it feels uncomfortable. But remember: the point is awareness, not judgment.

Yes, you might feel guilty looking at past purchases. But this is the start of something new—a healthier relationship with money. Give yourself some compassion and keep going. Building awareness is the crucial first step.

Related: Get a spending tracker worksheet in the free Spending Reset Guide.

2. Interrupt the Pattern

Awareness helps, but as we've discussed, maintaining that awareness all the time is exhausting. That's why it's helpful to set up "pattern interrupts"—small changes that trigger your brain to pay attention.

I experienced this recently when my usual grocery store rearranged everything. My quick, mindless shopping trip became draining and stressful because I had to think about every item and search for things that were always right where I expected them. It was exhausting—but it also meant I was much more intentional about what I put in my cart.

You can create similar interrupts in your own shopping habits:

For in-store shopping:

Make a list and keep it visible—remind yourself you're only buying what's on it

Skip the cart if you only need a few things (use a basket instead)

Shop somewhere less familiar or tempting

Give yourself a time limit

Put a sticky note on your credit card: "Do I really need this?" or "Will this end up as clutter?"

For online shopping:

Delete shopping apps from your phone, or move them to a less accessible spot

Remove saved credit card info so you have to enter it manually each time

Change your phone background to a reminder of your spending goals

Set limits on social media to reduce exposure to ads

Wait 24 hours before completing any non-essential purchase

The key is to create a small pause—a moment where you can switch from automatic to intentional. Anything that interrupts your usual pattern gives you the chance to make a different choice.

Read More: 7 Questions To Ask Before You Buy

3. Create New Patterns Ahead of Time

Before you shop (whether online or in-store), decide in advance what healthier habits you want to follow. What choices would feel aligned with your values and goals?

Writing these intentions down reduces decision fatigue in the moment. You won't have to remember or figure it out when you're tired—just read your list and follow your plan.

Some examples:

"I'll buy fresh produce and proteins, but stick to my list for everything else"

"I'll browse for 10 minutes, add things to my cart, then wait until tomorrow to purchase"

"I'll unsubscribe from one promotional email each week"

"Before buying, I'll ask: Do I need this, or am I trying to feel better?"

The more specific you can be, the easier it is to follow through.

Be Gentle With Yourself (This Is Important)

If you find yourself slipping back into old habits, remember: this is how your brain is designed to work. You're not broken, lazy, or failing.

Changing habits takes practice. It takes repetition. And it takes compassion.

Think about it: if a friend came to you feeling guilty about her spending, would you tell her she's terrible and should feel ashamed? Of course not. You'd be kind. You'd remind her that she's human, that change is hard, and that she's doing her best.

You deserve that same kindness from yourself.

What to Do Next

This week, try noticing just one habit. Be curious, not critical. What's one small change you could make to bring a little more intention to your spending?

You don't have to overhaul everything at once. Small shifts add up.

And if you're ready for more support—the kind that's gentle, practical, and shame-free—I created the 30-Day Gentle Money Reset specifically for this.

It's a 30-day journey with daily prompts, reflections, and activities that help you:

Build awareness of where your money goes and why you spend

Develop the self-compassion you need to change patterns without guilt

Start spending with intention instead of autopilot

It's not about budgeting rules or deprivation. It's about understanding yourself better and creating habits that actually feel good.

You've got this. And you're not alone in figuring it out.

Ready to understand your spending patterns without the shame? Learn more about the Gentle Money Reset here.