Why Traditional Budgets Don’t Work (and What to Try Instead)

Have you ever been scrolling through social media on your phone and come across something you wanted to buy? Maybe you've been eyeing a new pair of shoes for those icy winter sidewalks, or a kitchen appliance that promises to make your life just a little bit easier.

But then you hesitate.

You technically have money in your account right now, but will you have enough to buy all the groceries you need before your next paycheck? What about the bills due next week? And what if something comes up that you didn't plan for?

It's scary not knowing if this will be another one of those months where the faucet starts dripping and you need new tires and your child grows three inches and needs yet another pair of shoes—all at once.

You look at your bank account, hoping it will somehow tell you if this purchase is a good idea. But the answer isn't there. Should you put it on your credit card and hope for the best? After all, life is short, and this item would genuinely make your life better.

On the other hand, it's really stressful when those surprises happen and you can't afford them. And with prices fluctuating, inflation, economic uncertainty—it's hard to know what impact this one purchase will have on your overall financial picture. Plus, you know you should be saving more for the future, but it feels like there's always something.

Worrying about it all the time is exhausting, and you don't want to live constantly stressed about money. So maybe you hit "buy now" because the answer is unclear and you don't know what else to do. If you can't figure it out, you may as well live life well now, right?

If this sounds even remotely familiar, you're not alone.

Many people give up on budgeting because it's just so hard to plan for everything when you can't fully anticipate the future. On top of that, putting limits on your spending doesn't feel good. So it's completely understandable that you've stopped trying to figure it out.

At the same time, a part of you knows—sometimes deep down—that you should be doing better. And because you aren't, you feel like you're just bad with money. Everyone else seems to have it figured out, so why is it so hard for you? There must be something wrong with you, right?

Wrong.

The problem isn't you. Everything you're experiencing is normal and understandable.

The real problem is that most budgets don't actually help you plan for life's surprises and irregularities. We don't live life according to spreadsheets (and we wouldn't want to—that would be boring).

It's not that you're bad with money. It's that you can't clearly see what's happening with your money. Everything is jumbled together in one account, and you have no idea what you need, what you have available, or what might happen next month.

That's why you need a clear system that gives you exactly that clarity: the Two Checking Account Budget (also called the Intentional Money Method).

It's a simple way to manage your money without tracking every single transaction. By separating your money into things that are planned and scheduled versus things that aren't, you can give yourself the confidence to know that you have enough to pay all your bills (and save for the future) while being able to see exactly how much you can spend on everything else.

Why Budgets Fail (and It’s Not Your Fault)

Before we get into how to budget with two checking accounts, let’s talk about why other budgeting methods often don’t work.

Most budgets look like a math problem: take your income, divide it perfectly to cover bills and wants, and then stick to it. But life doesn’t work that way. It’s messy, unpredictable, and full of emotion-driven decisions.

In fact, the main reason budgets fall apart is unpredictable and inconsistent income and expenses—NOT because you’re bad with money. It could be the car breaking down, medical bills, replacing a broken appliance, or something you actually want to enjoy like a friend’s wedding or a last-minute trip. And having income that fluctuates makes it even more complicated.

The reality is that most budgets don’t build in the flexibility for handling these surprises and inconsistencies.

A Budget That Fits Your Life

So if you’ve struggled to figure out how to budget and make it stick, it’s not that you’re bad with money. You just need a system that combines structure and clarity with flexibility — so your money can adapt to your life, rather than the other way around.

That’s why I created The Intentional Money Method of managing your money with the Two Checking Account Budget.

The Intentional Money Method

This method is a flexible framework designed to:

Give you a clear picture of where your money goes

Show you exactly how much you can spend without guilt or worry

Build in wiggle room for life’s surprises

Help you align your money with your values and goals

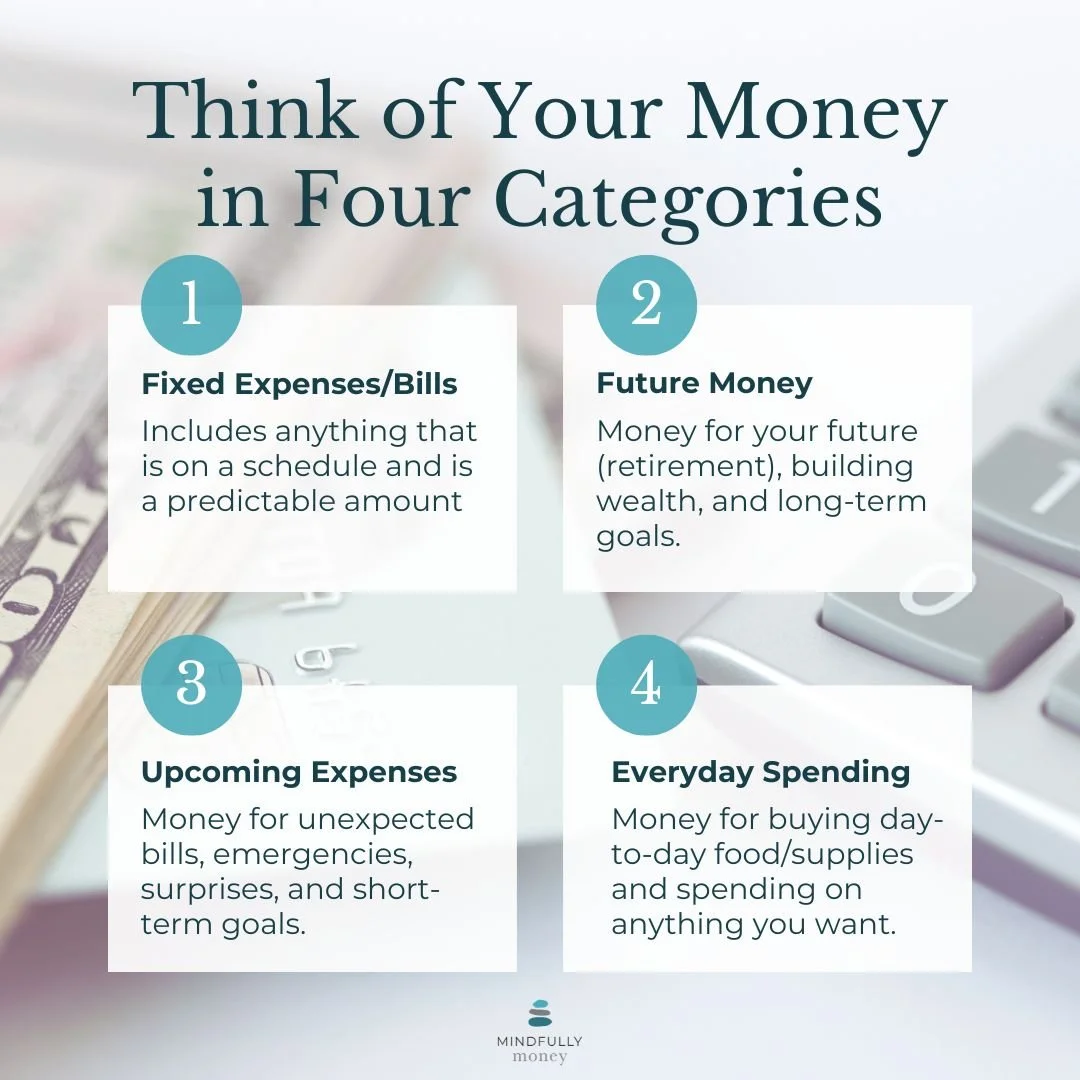

Instead of micromanaging every dollar, you think of money in four simple, purpose-driven categories:

Money for your essential bills and fixed expenses

Money for your future life goals and growth

Money reserved for upcoming expenses and surprises

Money for living your life now

This shift makes budgeting feel simpler and helps you feel confident and in control.

But here's what makes the Intentional Money Method truly different: it's not just about covering expenses—it's about aligning your spending with what matters most to you.

This means identifying your priorities—both your financial basics (bills, savings, security) AND the things that bring you the most joy and meaning in life. Then making conscious trade-offs: cutting back on what doesn't matter so you have more for what does.

It's about being intentional with your money so you can spend guilt-free on what you truly value, while naturally spending less on everything else.

How It Works

Most people pay their bills, buy what they need, and hope something is left to save or spend on fun stuff. Often, there isn’t anything left, and it’s easy to wonder, “Where did my money go?”

This happens not because you’re overspending, but because:

You can’t see what’s really happening with your money

You don’t know how much you can safely spend

You’re managing money reactively (responding to things that happen) rather than proactively (planning ahead)

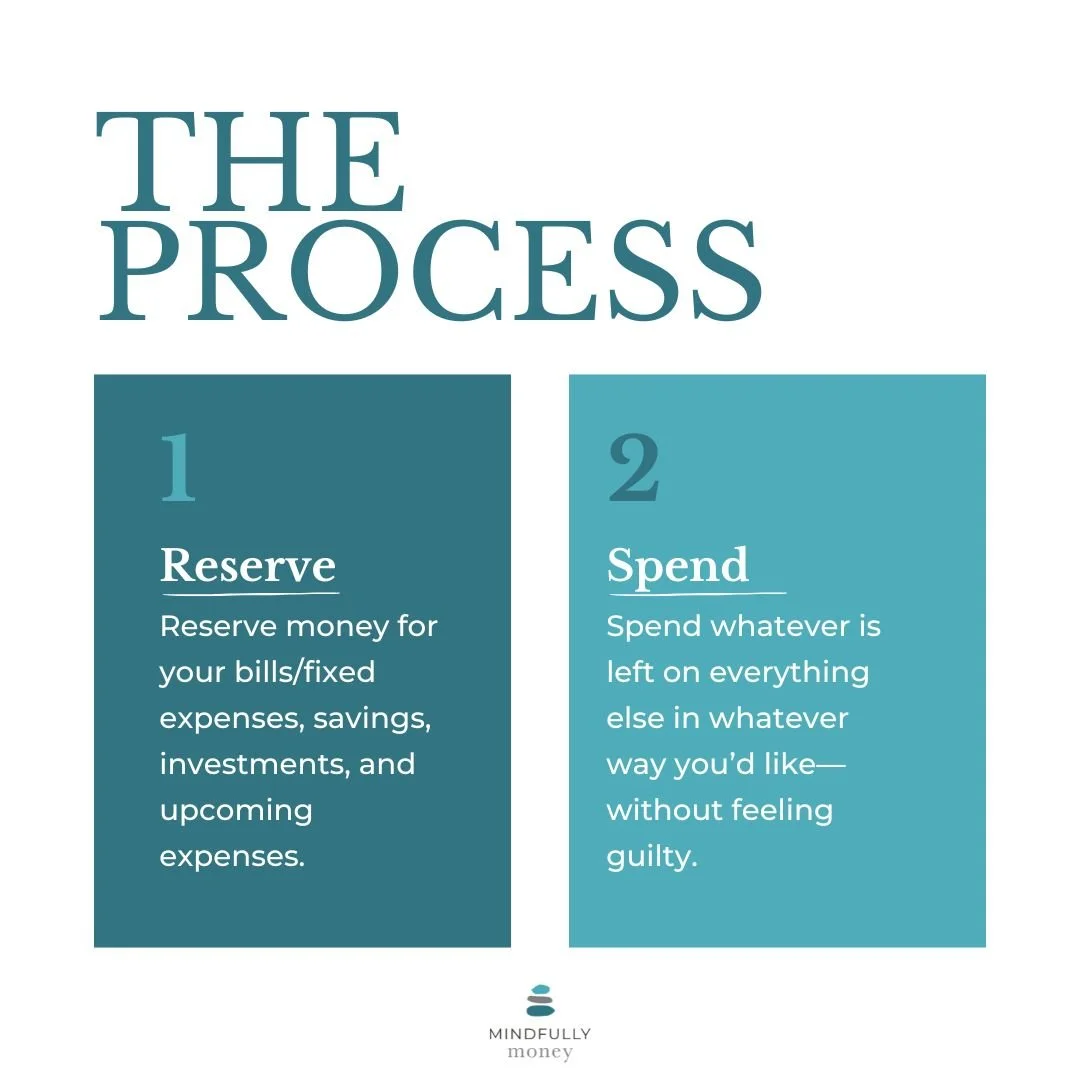

The Intentional Money Method helps you flip the script: you’ll learn how to prioritize your money first, then spend what remains in any way that makes sense for you.

Intentional Money Plan Steps

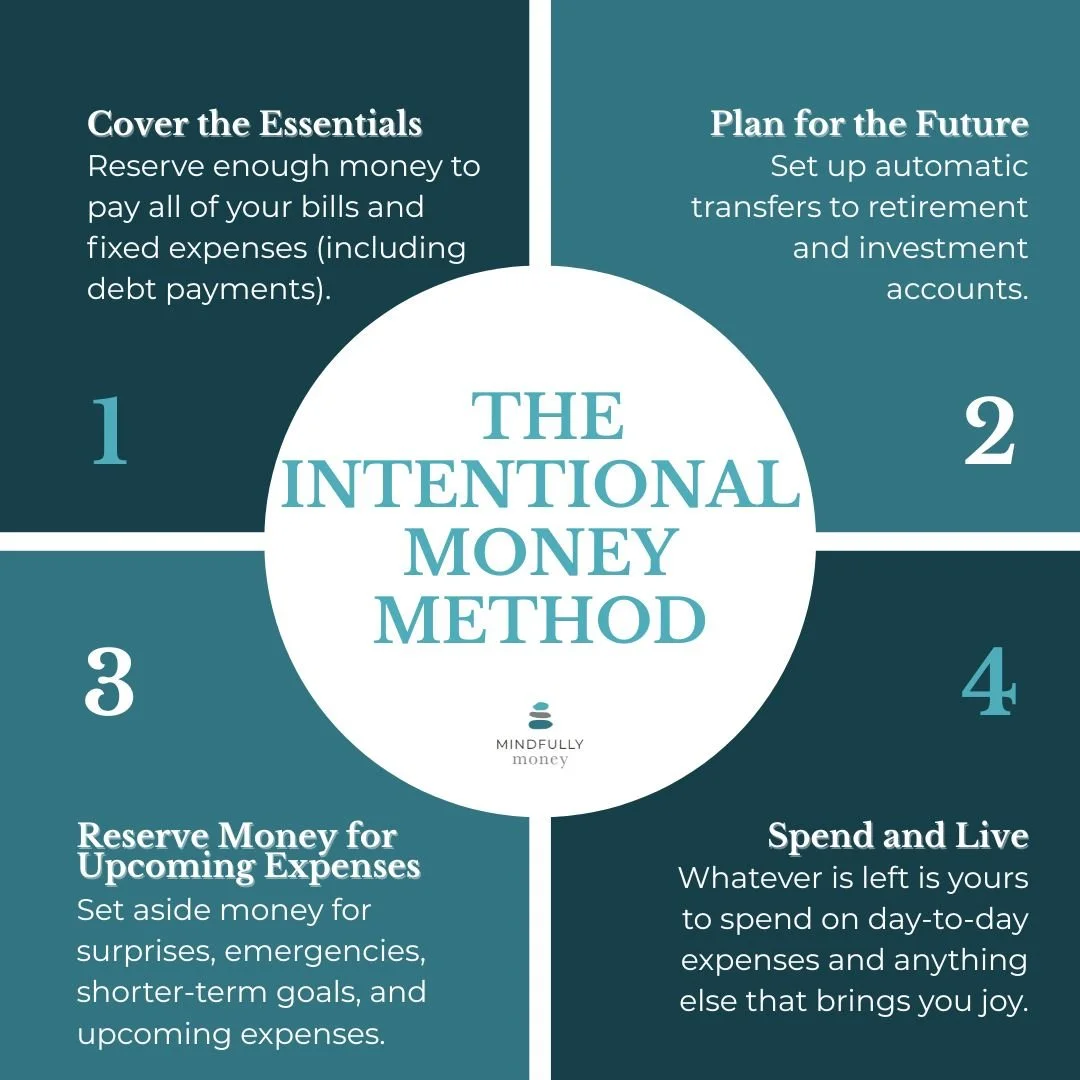

1. Cover Your Essentials

Purpose: Provide stability and peace of mind.

This is the money that keeps your life running—the bills and obligations that happen on a schedule and are a predictable amount. These are often monthly expenses, but can also include yearly, quarterly, or other scheduled bills.

It includes:

Rent or mortgage

Utilities, insurance, subscriptions

Minimum debt payments

Childcare or other consistent commitments

Anything that is on a schedule (whether a “need” or a “want”)

The goal is to reserve enough money each month to pay all of your fixed bills and obligations.

Guiding idea: Taking care of all of your fixed expenses first reduces stress and increases your sense of security.

Tip: Keep these in a dedicated account and automate payments. Once these are covered, you know what’s really safe to spend.

2. Plan for the Future

Purpose: Support long-term freedom and financial well-being.

This is your future money—what helps you build stability and independence over time.

It includes:

Retirement contributions

Long-term investments

High-interest debt paydown (if applicable)

Major life goals 5+ years away

Guiding idea: You’re caring for your future self by consistently setting aside money now.

Tip: Automate transfers right after payday. Even small amounts add up!

3. Reserve for Upcoming Expenses

Purpose: Prevent “surprise expenses” from becoming crises.

This is the money that helps you plan ahead for unexpected expenses, surprises, emergencies, and things that you want to have/do in the near future.

It includes:

Short-term goals (travel, home projects, gifts)

Irregular expenses (car repairs, medical, annual fees)

General emergency savings

Guiding idea: You’re giving yourself flexibility and the peace of mind to know you’ll be okay when life happens.

Tip: Use a separate savings account with clear labels (“Holiday Fund,” “Car Repair Fund”) and add regularly.

4. Spend and Live

Purpose: Manage your day-to-day life with ease and awareness.

This category includes variable essentials and daily spending—everything that fluctuates in both amount and timing.

It includes:

Groceries and household items

Gas and transportation

Restaurants, coffee, personal care, small shopping

Anything you feel like purchasing

Guiding idea: Now that you’ve taken care of your priorities, you can spend the rest in any way that makes sense to you.

Tip: Use a separate spending account with a set amount each payday. Track the balance to guide your spending.

How to Implement It: The Two Checking Account Budget

Now that you understand the framework, let's talk about how to make it work in your daily life.

The easiest and most effective way to implement the Intentional Money Method is to use the Two Checking Account Budget—a simple account structure that physically separates your money by purpose.

Here’s how it works:

You'll have two checking accounts:

Checking Account 1: Primary Checking Account

This is where your income lands first and where you handle Steps 1-3 (Bills, Future, Upcoming Expenses):

All bills get paid automatically

Money for future goals and savings gets transferred out

Money for irregular expenses gets reserved

You keep a comfortable buffer here

You rarely touch this account for day-to-day spending

Checking Account 2: Spending Checking Account

For variable everyday spending (Category 4: Spend & Live)

This is Step 4, your everyday money:

Groceries, gas, coffee, Target runs—all variable spending

The balance shows you exactly what you can spend guilt-free

When you check this account, you know: "This is what I have for life right now"

The basic flow:

Deposit all income into your Primary Checking Account

Pay bills and fixed expenses automatically

Transfer money to savings accounts

Transfer what's left to your Spending Account

Spend only from your Spending Account—the balance is your guide

This system helps you reserve money for bills and priorities while clearly showing how much you can spend on everything else. You never have to wonder if there's enough to pay your bills.

What Makes This Different

You might be thinking, "Okay, but how is this really different from what I'm doing now?"

Here's what makes the Two Checking Account Budget different from traditional budgeting:

No tracking every transaction. You don't need to categorize every purchase in the moment or write down every coffee you buy. You will do a simple monthly check-in to review broad spending categories and make sure bills got paid—but that's a 15-30 minute review, not daily transaction logging.

No guilt about spending. When you spend from your Spending Account, you're not "going over budget" or "breaking your plan." You're spending money that's already designated for spending. It's yours to use.

No complicated categories. You don't need to decide if something is "groceries" or "household supplies" or "entertainment." It's all just spending, and it all comes from one account.

No complicated spreadsheet. You don't need 47 spending categories or a detailed budget worksheet. Just a simple monthly review to track broad categories (groceries, fun, gas) and make sure your bills got paid. Your account balance is your budget—that's it.

Always know your number. At any moment, you can check your Spending Account and see exactly what you have available. No mental math, no checking multiple accounts, no wondering if you forgot about a bill.

Visual clarity instead of mental gymnastics. Your money is physically separated in a way that matches how you actually use it. Bills money stays in the bills account. Spending money goes to the spending account. Your brain doesn't have to keep track of invisible boundaries.

The result? You always know you have enough for bills. You always know what you can spend. You can finally breathe.

Tracking Your Money

Once you've got your system set up, you'll want a simple way to track where your money goes each month. This does NOT need to be complicated—no 30 categories or hours dividing up receipts.

You can choose any method you’d like (app, notebook, spreadsheet, etc), as long as:

It’s a system you will actually use every month

It allows you to check and make sure your bills got paid

It gives you some basic information about how you spent money so that you can make adjustments as needed

Learn more about tracking your finances in general, or get the system and template I use for tracking my finances (complete with instructions on how to use it).

The Goal Is Not Perfection

Creating a plan for your money isn’t a one-and-done situation where you do it once and then you’re done. Your life will naturally evolve and your budget should too. So let go of the idea that you’re going to design this perfect budget the first time around and start viewing it as an ongoing process where you change and adapt over time.

There’s no way to predict what life will bring, so do your best to plan what you can, build some wiggle room and flexibility into your budget, and keep going.

If you’d like someone to walk through this process with you and help you create your plan, I’m here for you. Check out my financial coaching page and schedule a free call to learn more.

-

The two checking account budget is a simple money management system that uses two checking accounts: one for bills and savings (your Primary Account) and one for everyday spending (your Spending Account).

Your paycheck goes into the Primary Account first, which automatically handles your fixed expenses and transfers to savings.

What's left over goes to your Spending Account—that's your guilt-free spending money for groceries, gas, fun, and everything else. The balance in your Spending Account always shows you exactly what you can afford to spend right now.

-

The most effective way to budget with multiple bank accounts is to use each account for a specific purpose instead of trying to track categories in your head. With the two checking account budget, your Primary Account handles all predictable expenses (bills and savings), while your Spending Account is for everyday variable expenses. This physical separation does the budgeting work for you—your account balances show you what's available for each purpose. You can keep both accounts at the same bank for easy transfers, or use different banks (like a traditional bank for bills and an online bank for spending). The key is automation: set up direct deposit, automatic bill payments, and scheduled transfers so the system runs itself with minimal management.

-

Using credit cards is a great way to gain additional consumer protections and rewards. While it does add an additional layer to managing your finances, there are some simple ways to use credit cards with the Two Checking Account System.

The best way to do it is have two credit cards that align with your two checking accounts. Use one card for bills and one for spending.

To make things clear and simple, do ALL of your spending (as much as possible) on your spending credit card so that you can easily see the total amount outstanding and compare it to the amount in your spending account.

-

Yes! This system is perfect for irregular income because it standardizes what happens each month.

Essentially, in the months that you earn more money, you’ll reserve the extra to be used in lower-earning months.

Schedule a call with me if you’d like help figuring out how to make this work with your situation.