How to Budget for Irregular Expenses Using Sinking Funds

Budgeting for irregular expenses gets much easier when you use sinking funds.

One of the biggest challenges when it comes to budgeting is planning for irregular expenses—those that are not the same from month to month. For example, heating bills in states with cold winters will be higher in certain months of the year. Some months require higher spending for holiday celebrations and gifts. Summer months might require higher childcare expenses because kids are not in school. So how do you work these irregular expenses into your budget?

Sinking funds.

What are sinking funds?

A sinking fund is typically a savings account into which you set aside money for expenses that haven’t happened yet, but that you know will happen.

A sinking fund could be specific—for just one purpose. Or it could be more general, such as one savings account for all of your variable living expenses.

Why do you need a sinking fund?

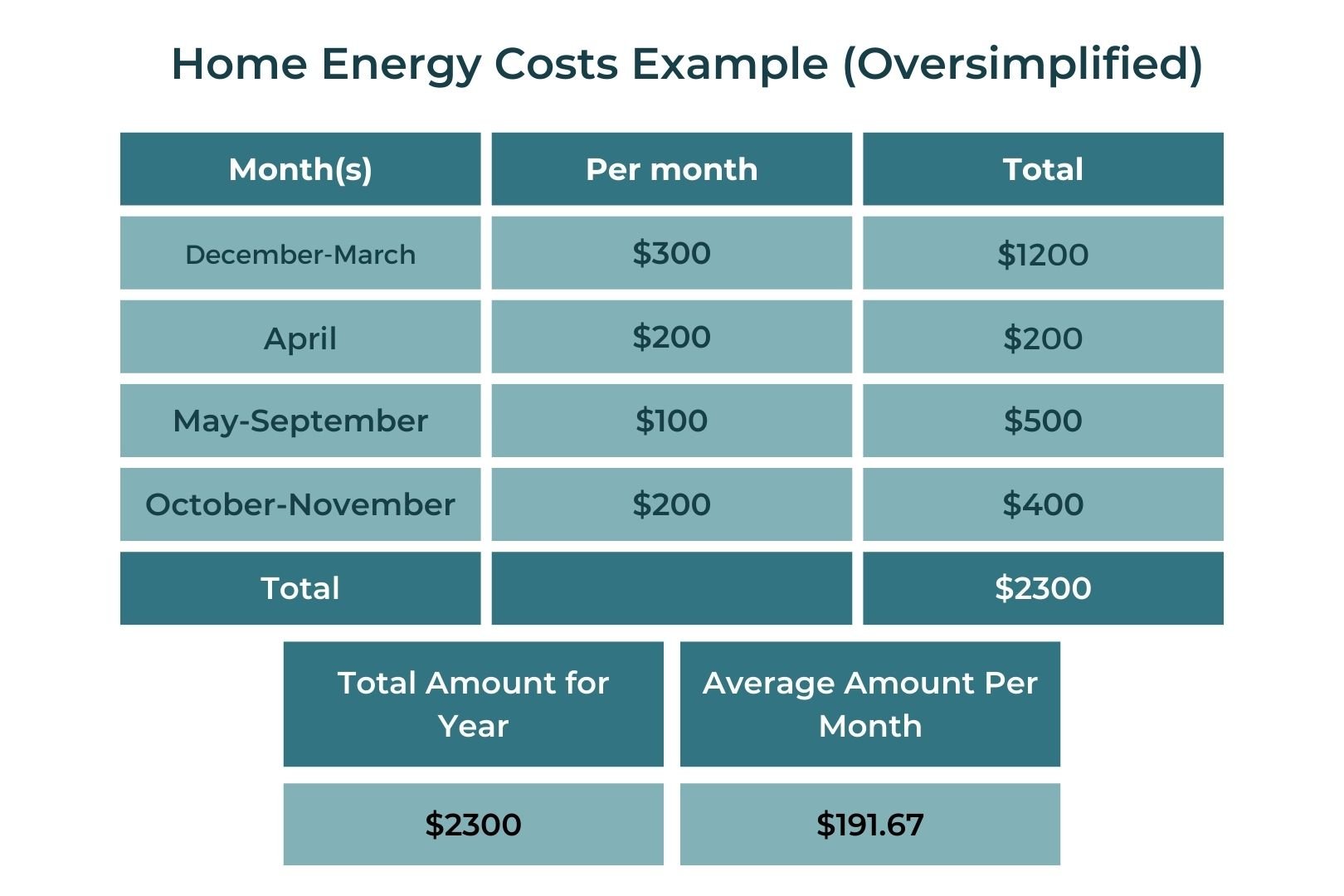

Let’s say that you start budgeting in June (in the northern hemisphere), and your energy costs are $100/month. So every month, you plan on $100/month and you use the rest of your money for your other living expenses and things you want/need.

Then December arrives and your home energy costs go up to $300/month. You haven’t planned for this and now you suddenly need to find an extra $200. Maybe you put it on your credit card and hope you can pay it later. But then next month you still haven’t found the extra $200 and the credit card bill you can’t pay keeps getting higher.

Sinking funds help you avoid this situation by setting aside money for the higher winter energy bills throughout the year.

The purpose of a sinking fund is to ensure that you plan ahead for expenses and are always able to pay for everything in full (rather than putting it on a credit card that you can’t pay off right away).

Hint: They can be used for fun things too.

What are some examples of sinking funds?

Here are some ideas of what sinking funds you could have:

A vacation fund

Fun spending money

Home and auto insurance

A fund for unexpected home and car expenses (new tires, water heater, etc)

Birthday and holiday gift fund

Haircuts and other personal services

Babysitters

Eating out

Anything that isn’t the same amount from month to month is a good candidate for a sinking fund.

How do sinking funds work?

Here’s how to set up a sinking fund, using the example of the higher winter energy costs:

1. Figure out the total amount you spend on energy costs throughout the year.

If you’ve been in your home for awhile, you should have records of past bills. If you are new to your home and don’t have a historical record, talk to neighbors and do a Google search for energy costs in your area. You might even be able to get some information from your energy company.

2. Divide the total for the entire year by 12 to get the average monthly amount.

3. Set up an automatic transfer of this amount each month into a savings account.

4. Include the amount you transfer to your sinking fund as a line in your budget. Think of it as a bill to pay.

Important:

If you start doing this in the higher cost months, you will need to set aside the highest amount ($300 in this example) for a while to make sure there’s enough to cover the full bill. Once you are past the highest months, you can switch to the average amount instead. This will allow you to build up your sinking fund to cover the expensive months in the future.

It’s a good idea to put more than the average cost in your sinking fund to account for price increases or unusual energy events such as particularly hot summer or cold winter. This will also protect you from accidental overdrafts.

Is a sinking fund the same as a savings account?

A sinking fund could be in a savings account, but it is not necessarily the same thing as a savings account. You certainly can open a separate savings account for each sinking fund. And that may be the method that works best for you.

Another option would be to open a savings account at a bank that allows you to subdivide your savings into categories, such as Capital One 360 or Ally.

Many apps also give you the option of creating buckets within your savings account. Although you wouldn’t see the different categories when you log in to your bank, you could tell how much is allocated to each fund when you are in the budgeting app.

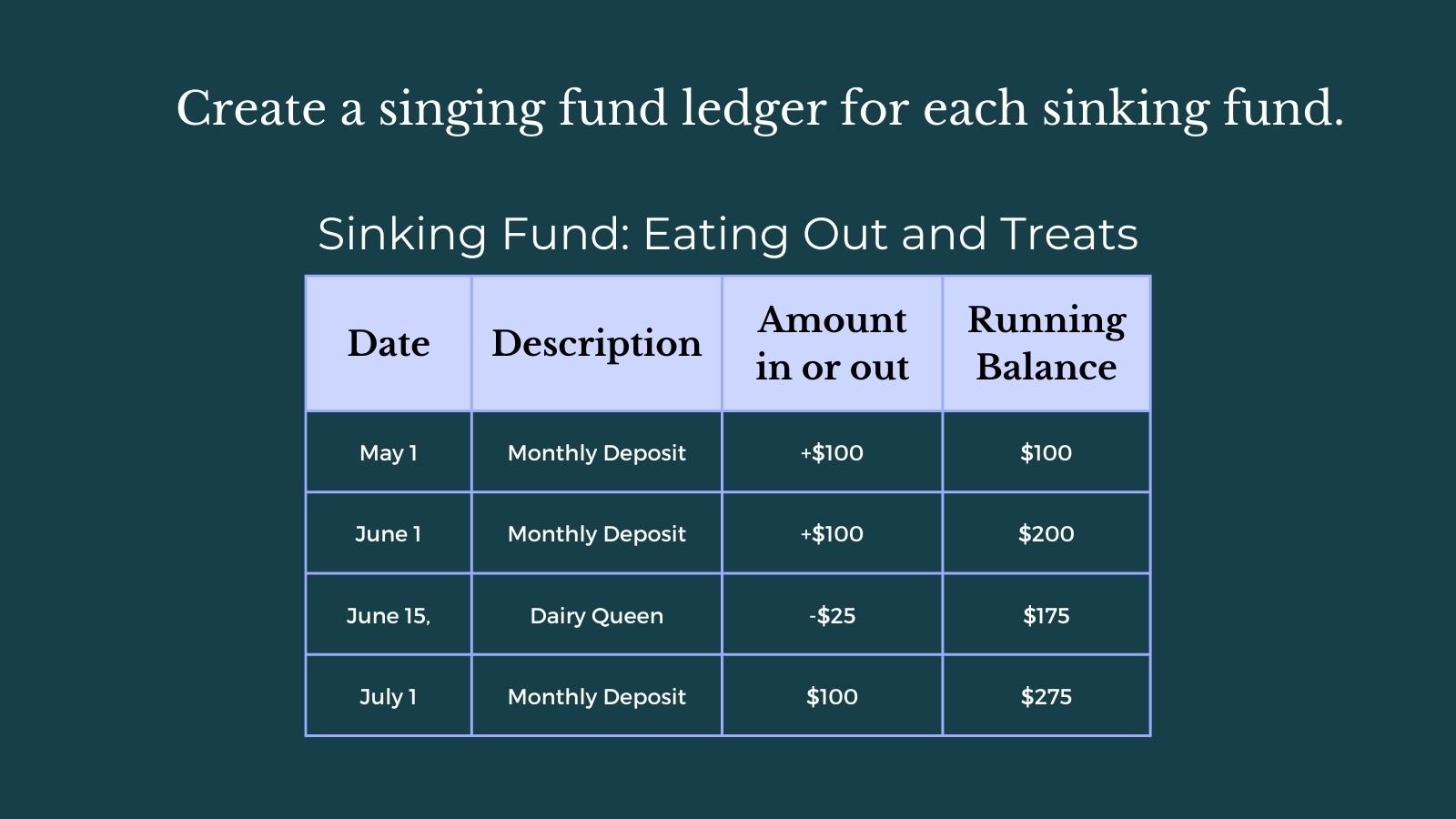

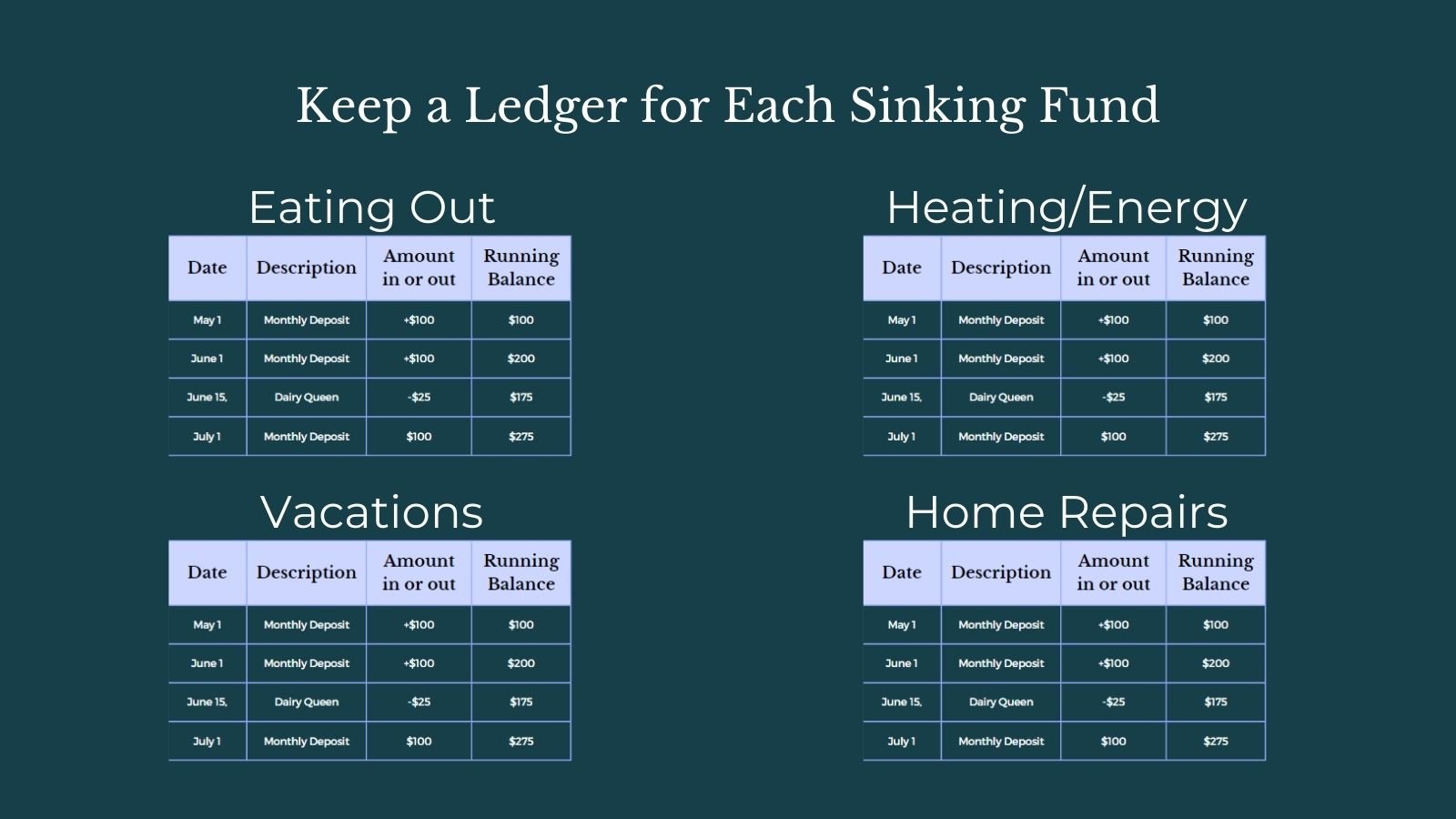

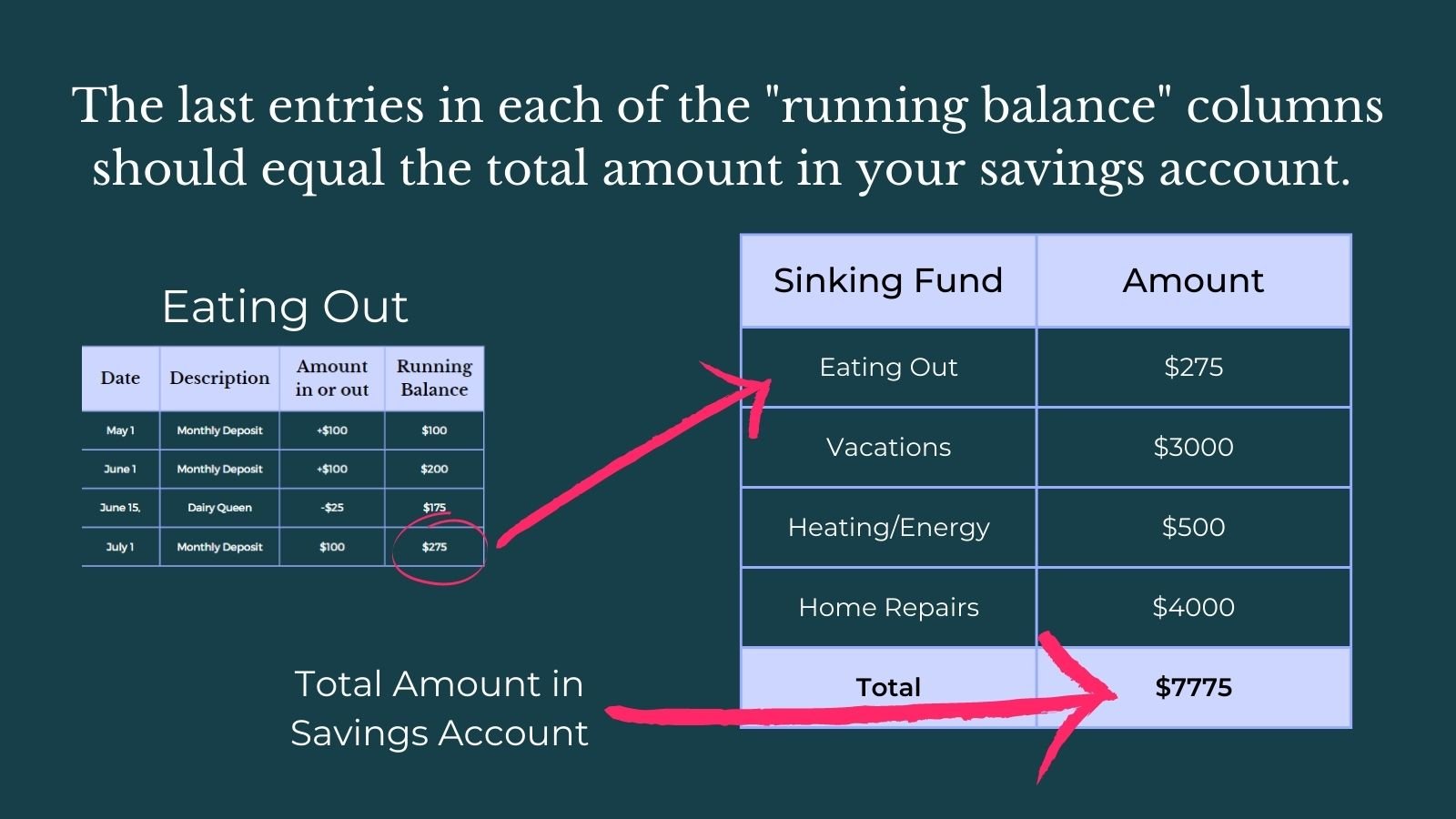

You could also do this with pen and paper or a spreadsheet. Basically, you would create a ledger of money in and out for each purpose.

Isn’t this what my emergency fund is for?

No. An emergency fund is for truly unanticipated and catastrophic events that threaten your ability to survive. Where an emergency fund is for things you can’t anticipate (job loss, health problems, loss of home due to fire or weather), your sinking funds are for things that you know are coming, even if you don’t know exactly when or how much.

For example, new tires are not an emergency. Higher energy costs in the winter are not an emergency. Getting invited to your best friend’s spontaneous wedding next month is not an emergency. While these things can feel like major catastrophic events (well, maybe not the wedding), they are things that you can, to some extent, anticipate.

You may not know when your tires will need replacing or you’ll need a new dishwasher, but as a home or car owner, you know that something will go wrong at some point. You should be saving for these events ahead of time so that you don’t have to use credit card debt to pay for it.

Similarly, you should be saving for weird, but fun events that you might want to attend at the spur of the moment. Because if you don’t plan for it, you can’t afford it.

Sinking funds are the way to make sure you have money available for when something happens.

An emergency fund, on the other hand, is for “oh crap, I lost my income and now I need to figure out how to buy food.”

That said, if you have enough self control to not spend whatever money is in your savings account, you can totally include your emergency fund in the same account as your sinking funds. Just make sure there’s money in it set aside for true emergencies.

Pin this image to save for later:

Pin this image to save for later!